Ledn Blog

The Bitcoin Economic Calendar - Week of March 22nd 2021

Fed ends SLR exemption for banks - now what? How rising yields could impact Bitcoin. Portfolio tips from Ray Dalio.

Not yet a Ledn client? Start earning 12.50% APY on your USDC and 6.00% APY on your Bitcoin - click here to open your Ledn account!

Follow us in social media:

The Bitcoin Economic Calendar:

Week of Monday March 22nd to Sunday March 28th.

Market Commentary:

Bitcoin: Bitcoin sold off slightly during "stimulus cheque week" - closing last week down -2.77% at $57,381. The S&P 500 and the Dow Jones were also down for the week, with the Nasdaq rising. There were positive developments for Bitcoin during the week, like Visa stating that they are looking to "enable purchases of Bitcoin on Visa credentials,".

Considering the backdrop, the price action may signal that some investors are selling into the momentum of the stimulus cheques. We are also heading into another options and futures expiration week, which tend to be volatile periods. As a note, Bitcoin has had 4 down weeks out of the last 10 - for a cumulative drop of -40.2% during the 4 down weeks. The 10-week period prior to that only saw 2 down weeks - for a cumulative drop of -2.45%.

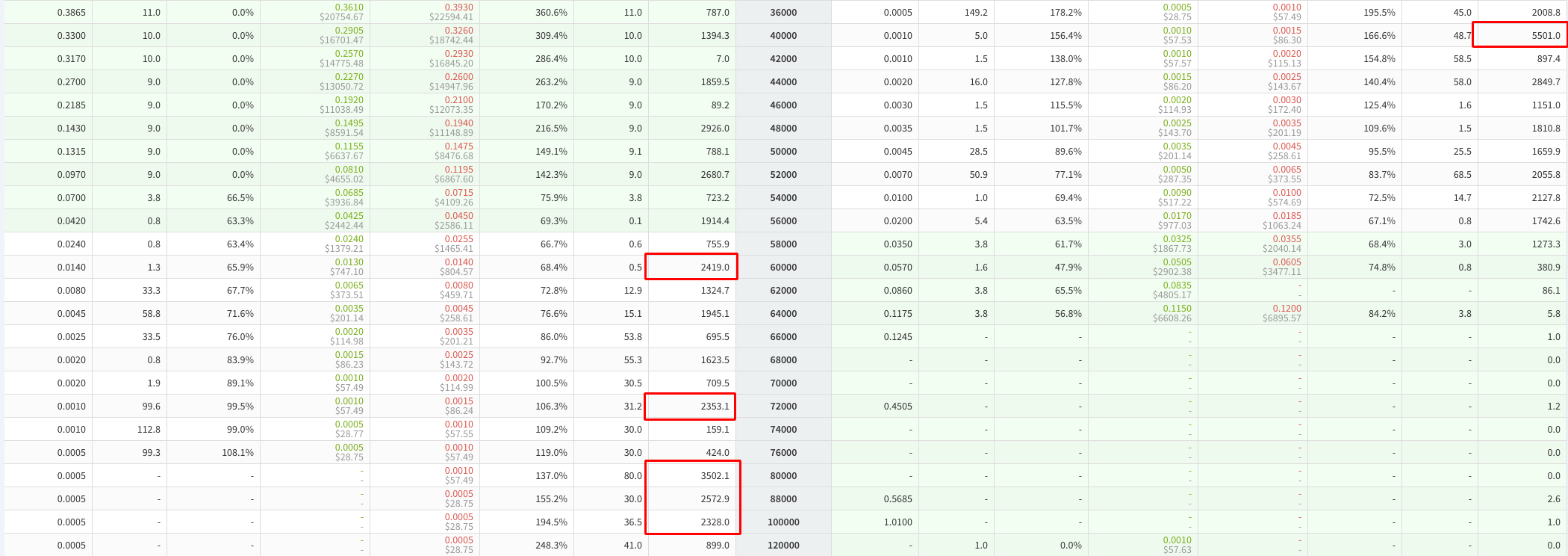

As a result of the recent price action, the perpetual futures funding rates for Bitcoin across major exchanges are mixed, with FTX and Binance showing above their 30-day moving averages, and others below - this could be another sign of potential volatility going into the week. On the options side, the open interest across most price strikes on the call contracts looks evenly distributed. On the Put contracts, we see a significant open interest in the $40k level, well out of the money going into expiration.

Rising treasury bond yields took the spotlight again last week. Interestingly, this can be interpreted as investors pricing in future inflation, which is good for Bitcoin in the long-term. However, it could have negative short-term effects for Bitcoin due to market dynamics that we'll get into in our What's Ahead section later today.

S&P 500: The S&P 500 closed the week down -0.88% at 3,909. All of the losses for the week came on Thursday and Friday as the Fed stated that it would be ending the Emergency Capital Relief for big banks - the SLR exemption that we have been discussing over the last 3 weeks.

The move sent treasury yields soaring, with the yield on the 10-year note rising 5.93% settling at 1.71% and touching a high of 1.75% - the level we had been discussing 4 weeks ago. Predictably, the move sent ripples through the markets - the yield on the 10-year treasury has been rising for 8 consecutive weeks, with both Jamie Dimon and Ray Dalio saying they would not touch the 10-year treasury note "with a 10-foot pole".

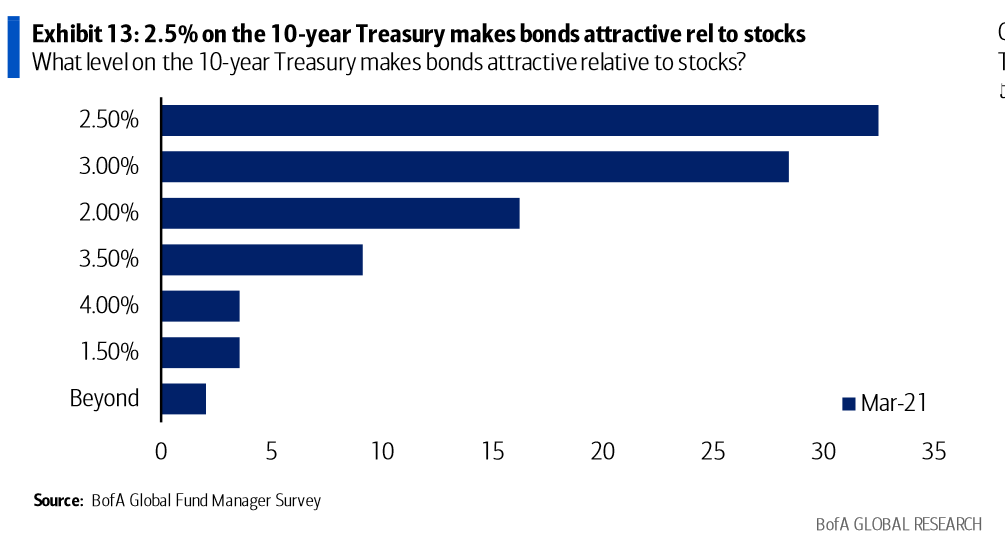

If yields rising have become the consensus view, what market participants want to anticipate is: 1: How high can they go? 2: How could that impact his/her portfolio? To try to answer the first question, we can look at some investor sentiment around when they think bonds become "cheap" relative to stocks. When bond yields rise, the price of the bond drops, at some point, they become attractive to own. Let's look at a recent survey conducted by Bank of America:

According to the survey, almost 35% of investors surveyed see a yield of 2.5% or higher on the 10-year treasury as the point at which owning the bond becomes attractive over owning stocks. Notice how there is no mention of 1.75%, the current level. The tipping point at which more than 50% of investors believe it is attractive is somewhere between 2% and 2.5%. Why is that level so important? The chart below shows the historical yield on the 10-year note - as you can see, it has been on a down trend since the 80s, and going above 2.5% could challenge that trend.

If we play out the survey results, equity markets could continue to be under pressure, and the yield on the 10-year note could keep going higher, until it goes north of 2%, where it could find some buyers and potentially some balance. We'll discuss how that can impact Bitcoin in our What's Ahead section.

Gold: Gold caught some footing, finishing the week up +1% at $1,744 per ounce. Interestingly, it shook off a rising dollar for the week. As it was pointed out by Lyn Alden on a tweet this week, Gold is inversely correlated to the real long-term rates. Meaning, as real rates go higher, gold goes lower.

It will be interesting to keep an eye on this dynamic as treasury yields continue to rise.

DeFi: With Ethereum and Bitcoin both down last week, the FTX DeFi index bucked the trend - closing higher by +1.48%. While there has been no further developments on the looming potential legislation out of the U.S., we are starting to see the first glimpses of institutional support for Ethereum, with Meitu becoming the first publicly listed company to purchase ETH for its reserves.

Meitu is a publicly listed Chinese Technology company - and it has started to be touted as "Asia's MicroStrategy". Time will tell if other publicly listed companies in China will follow-suit. Nonetheless, it is fascinating to watch how much of a global phenomenon crypto is across corporate treasury boards.

Difficulty Commentary: We had a new difficulty adjustment kick in on Friday which brought mining difficulty to a new all-time high of 21.87 TH. The mempool is still pretty clogged so you can expect transaction times and fees in similar levels as the last 14 days.

What's ahead for the week:

The Chairman of the Federal Reserve is testifying before Congress twice this coming week, and a dozen other Fed speeches are scheduled for the following week. This, as per the headline below, could be a source of volatility for the markets. In addition, there's Gamestop earnings on Tuesday.

Bond market expert Ray Dalio from Bridgewater gave some interesting portfolio advise for the current market in an interview over the weekend. Interestingly, Mr. Dalio said that "cash is trash" right now, and holding it costs you 2% annual - according to Mr. Dalio "that's a lot". His advise in this environment was:

1. Do not to hold cash. If anything, borrow cash to buy something else.

2. Diversification is important: make sure you own different assets classes, exposed to different currencies, in different geographies.

Lastly, let's chat for a second about how rising interest rates could impact Bitcoin in the short term. If rates rise enough, it will put pressure in the stock market. When this happens, high-growth stocks, namely in the technology sector, tend to suffer the most. This impacts bitcoin because selling pressure on Growth/Tech ETF funds like Ark increases. Ark owns GBTC as one of its underlying assets, and as the fund gets smaller, it has to trim its long GBTC holdings - which, in turn, puts downward pressure on BTC spot. Similarly, as bond prices become more attractive to own relative to stocks, any "long" portfolio that has any exposure to say Microstrategy, GBTC, or any other BTC-related trade in the stock market, will see the size of its allocation trimmed - which will have a similar same effect. In the long-run, this selling pressure should net out with the immense pressure to put dollars to work and shield from inflation, and the long-term trend upwards for bitcoin should be resumed. However, it is always good to understand how pressure on growth/tech stocks could spill over to Bitcoin.

Kind reminder that this week is options and futures expirations week for the March contracts, and that we are heading into the final week of commentary for the potential law out of the U.S. treasury to regulate digital asset transactions.

As always, we'll keep you posted on any relevant news throughout the week right here and from our Twitter account @hodlwithLedn

Canadian Central Banking Updates:

Current Target Interest Rate: 0.00 - 0.25%

Current Overnight Money Market Rate: 0.23%

Source: https://www.bankofcanada.ca/rates/

U.S. Central Banking Updates:

Current Fed Interest Target Rate: 0.00 - 0.25%

Current Effective Federal Funds Rate: 0.09%

Source: https://apps.newyorkfed.org/markets/autorates/fed%20funds