Ledn Blog

The Bitcoin Economic Calendar - Week of March 8th 2021

Stimulus math: calculating how it could impact Bitcoin. Why U.S. banks could follow Germany's footsteps in offering negative interest rates.

Not yet a Ledn client? Start earning 12.50% APY on your USDC and 6.00% APY on your Bitcoin - click here to open your Ledn account!

Follow us in social media:

The Bitcoin Economic Calendar:

Week of Monday March 8th to Sunday March 14th.

Market Commentary:

Bitcoin: Last week provided some very interesting price action and saw Bitcoin rising +12.66%% to settle at $50,967 - over the all-important $50k level. There are several driving macro trends that we will into, namely how the recently approved stimulus will affect market dynamics when it hits the streets, and what is happening in the U.S. Treasury markets. First, let's do some stimulus math and see how that could impact Bitcoin.

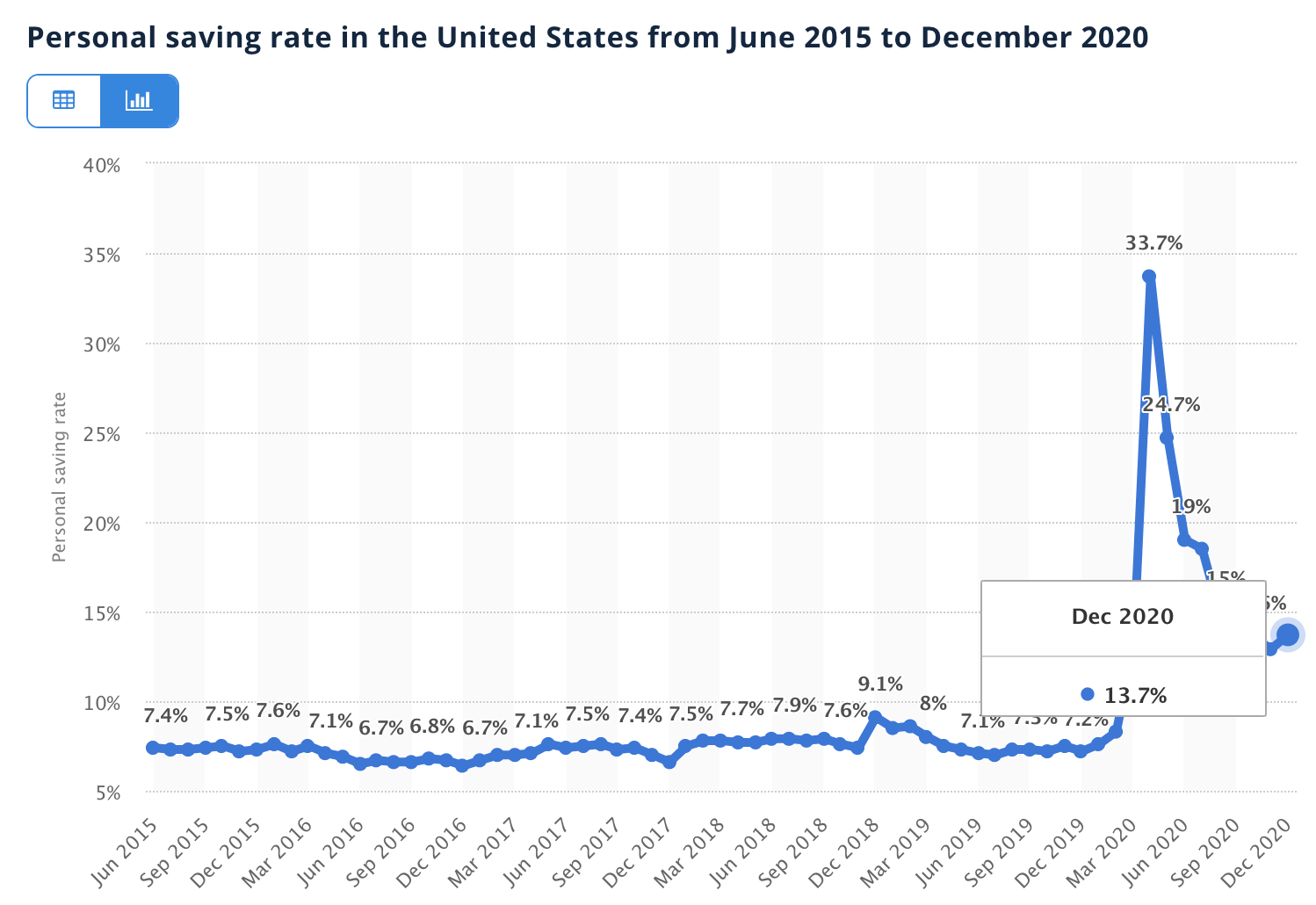

To set the stage, the Savings rate for the U.S. consumer for the month of January was 20.5% - this is incredibly high. For context, it has traded below 10% since 2015.

Now, the last round of stimulus cheques went out to 159 million people, and over $267 Billion were distributed. This works out to an average of $1,679/person. While the criteria to qualify this time around sees to be different, the overall amount to be distributed through the overall package is significantly higher than Trump's previous package. Let's take a look at what happened to Bitcoin since the first stimulus cheque was issued on April 29th, 2020.

With stimulus also come inflation expectations - and a potential desire to hedge. If we assume that 5% of stimulus cheques recipients will put at least $200 of their proceeds to Bitcoin/crypto markets, this represents a potential influx of $1.59 Billion dollars - a similar amount to what Tesla recently purchased for its balance sheet. If you play with the sensitivity of those assumptions you can get to much larger amounts.

S&P 500: Last saw some very interesting activity in the treasury markets, yet equities were able to shake off a rising yield curve and a stronger dollar and rallied higher - with the Nasdaq and the Dow Jones Industrial hitting fresh all-time highs. The S&P closed the week up 0.81% at 3,842. During the last few weeks, there have been signs in the market that investors are becoming interested in value and industrial stocks. This can be seen in the performance of stocks like Exxon Mobile (XOM), U.S. Steel (X), and American Airlines (AAL) - as well as rising commodity prices in oil, copper and aluminium rallying recently. This is healthy for the markets as, until recently, the rally had been most beneficial for technology companies and financial companies. While some market observers reflect to what is happening as the rally "taking a pause", there are reasons to believe it is quite the opposite, and rather than pausing, it is gaining strength for another leg up.

Yes, technology and growth companies have been underperforming in the last few weeks relative to industrials and commodities, but this phenomenon is also consistent with a broadening rally and reflecting the dynamics in the treasury markets - where yields are rising. Rising yields mean that investors are pricing in an economic recovery, inflation, and the fact that the Fed will have to act to cool down the economy from getting too hot. All of these factors are positive for companies and their earnings. What we are seeing right now is a reflection of how companies are valued and priced by investors and analysts. Rising rates tend to affect companies that have higher rates of growth more so than mature companies, given that growth companies have to discount their future cashflows are a higher discount rate - and a lot of their value today is implied from their growth into the future. When you project earnings out for 5 years and you discount them at a higher rate, the higher your future earnings growth, the bigger the impact to your current valuation.

So, it is important to stay focused on the big picture. If you don't, it is easy to get distracted by headlines such as "growth companies" are being hurt. What we're seeing play out in the markets could be considered "textbook", and expectation that rising rates signal is that the economy at large, and the companies participating in it, will do very well during the next part of the cycle.

Gold: Gold continues to underperform. Although we had rising treasury yields and a rising dollar, the prospect of a passing fiscal stimulus package in the U.S. was able to drive most equity and commodity markets higher. However, Gold had a significantly down week losing -1.97% and closing below the important $1,700 level at $1,698. Given that there are growing expectations for a strong recovery, investors may be looking to divest out of gold and into asset classes that stand to "run" a bit faster and a bit farther in the next 6-12 months.

DeFi: A lot of drama and exploits in DeFi land weren't enough to slow the FTX DeFi index down this week. It closed the period up +21%, getting closer to its previous all-time high than both Ethereum and Bitcoin. This tends to be considered as "relative strength" and can be an indicator of a sector's resilience relative to the rest of its peers in the market. Having said that, DeFi continues to show that it can be a high stakes game with headlines such:

And while the project above may not have grabbed too many headlines as it did not involve a DeFi "bluechip", there continues to be drama on that part of the industry as well with a recent breakup that affected Yearn Finance.

That being said, the price action speaks for itself in that investors remain interested in this side of crypto. Another part of the industry that is gaining attention is the NFT world. We'll be diving more into that in future posts as well.

Difficulty Commentary

A new difficulty adjustment kicked in last week and brought down difficulty down -1.34% at 21.44 TH. The mempool is still quite bloated relative to historical levels but transactions can still be confirmed in an orderly fashion (if you pay enough).

What's ahead for the week:

To prop up the treasury markets and keep yields low during the pandemic, the Federal Reserve started allowing banks to accumulate Treasury bonds without counting towards their Suplemental Leverage Ratio. This was done to encourage banks to purchase treasuries as the deposits in their balance sheets grew thanks to the stimulus cheques. By creating this exemption, the banks' balance sheets would be less strained as a result of the new deposits, since they could buy Treasury notes as their savings balances grew, and their SLRs were not affected. A bank's Supplemental Leverage Ratio is used to calculate how much equity capital they must keep relative to their leverage exposure. This exemption is due to expire on March 31st, and the Fed has not provided guidance on whether this would be extended. If this exemption is not extended, banks will need to go to the market to sell Treasury notes, which will drive yields higher.

As discussed by Credit Suisse strategist Zoltan Poszar in the recent Bloomberg OddLots podcast, this is important because banks are about to potentially receive trillions of dollars in new savings deposits from stimulus proceeds, and their balance sheets are constrained. Said differently, they have no-where to put it ro earn a positive return and be accretive to their business. As an example, there are already banks that are telling their institutional clients that they have to pay fees to hold cash balances in excess of those held in December 2020.

As Mr. Pozsar describes, once the stimulus hits the street, banks will likely try to push clients to money-market accounts instead of savings, but there is also a structural limitation to that in the Repo market, where banks can only place $30 Billion per counter-party. What this means is that the Fed will have to be creative to allow banks to take in the new deposits. Depending (or regardless) of what the Fed does, the U.S. might find itself in similar shoes as Germany - where banks have started telling large depositors that they most _pay_ a 0.5% annual rate to hold large deposits with them.

All of this could lead to some unexpected side effects in the overall economy, and could continue driving people in the U.S. to explore options like Bitcoin and/or stablecoin savings accounts like Ledn's - where they can earn much better rates.

As always, we'll keep you posted on any relevant news throughout the week right here and from our Twitter account @hodlwithLedn

Canadian Central Banking Updates:

Current Target Interest Rate: 0.00 - 0.25%

Current Overnight Money Market Rate: 0.23%

Source: https://www.bankofcanada.ca/rates/

U.S. Central Banking Updates:

Current Fed Interest Target Rate: 0.00 - 0.25%

Current Effective Federal Funds Rate: 0.09%

Source: https://apps.newyorkfed.org/markets/autorates/fed%20funds