Ledn Blog

The Bitcoin Economic Calendar - Week of April 12th 2021

Coinbase begins trading this Wednesday - how do its numbers compare to Goldman Sachs? Big banks looking at Bitcoin Futures. U.S. Home prices are soaring.

Not yet a Ledn client? Start earning 12.50% APY on your USDC and 6.10% APY on your first 2 Bitcoin - click here to open your Ledn account!

Follow us on social media:

The Bitcoin Economic Calendar:

Week of Monday April 12th to Sunday April 18th.

Market Commentary:

Bitcoin: After getting to within USD $500 of its all time high, Bitcoin succumbed to selling pressure to settle the week at $59,997, up +3.04%. While it was unable to close above $60k, the closing price on Sunday evening marks Bitcoin's highest weekly close ever. Momentum continues to build around crypto assets, which now surpass USD $2 Trillion in total market capitalization. Ethereum also reached a new all-time high of its own - touching $2,197 intra-week to settle at $2,148, up +3.49%.

All eyes are on Coinbase, as its shares start trading on the Nasdaq under the ticker COIN this Wendesday. Its Q1 2021 earnings, released last week, were a sight to behold. Here are some highlights:

Revenue: $1.8 Billion (up over 900% from Q1 2020)

Net Income: $730 Million

Verified users: 56 Million

Trading Volume: $335 Billion

Assets on Platform: $223 Billion

According to the Wall Street Journal, this sets up Coinbase for a valuation of $70 Billion, roughly implying a ~25x price-to-earnings ratio (PE) based on earnings forecasts for the rest of the year. For context, Goldman Sachs is expected to post Q1 2021 earnings of approximately $3.2 Billion and trades at a market capitalization of $113 Billion - for a current PE ratio of 13.37x. One difference is that Goldman's revenues are growing by roughly +20% year-over-year, while Coinbase's revenues are growing by more than 900%. More on this in our What's Ahead section.

Elsewhere, signs of U.S. asset prices heating up continue to surface. With Bloomberg reporting that almost half of homes in the U.S. are selling within one week of being listed, a record pace.

Lyn Alden, founder of Lyn Alden Investment Strategies, points out that many economic indicators and corporate earnings for the period of March and April 2020-2021 can provide very impressive year-over-year growth percentage numbers given the "low-base" effect from March and April 2020. She points out that this already happened in March for Producer Price indexes, and that Consumer Price indexes could likely follow-suit in April.

On the Bitcoin options front, we are seeing sizeable open interest in the $80k strike for April 30th - almost 7,000 contracts. On the put contract side, we are seeing around 4,000 contracts in open interest in the $52k and $50k strikes respectively. The April futures contract is trading at around 10% annualized premium from spot at the time of writing. Perpetual swaps funding rates for Bitcoin are above their 30-day moving averages, which can signal upcoming volatility.

S&P 500: U.S. capital market indexes moved significantly higher last week, with the S&P 500 closing up +2.12% at 4,124. The Dow Jones was up +1.95% at 33,800 and the Nasdaq was the big winner again, up +3.48% at 13,900 points. The VIX is now well within its pre-pandemic range, and the 10-year Treasury note yield has been essentially flat for the past 4 weeks, which has brought some comfort to the markets.

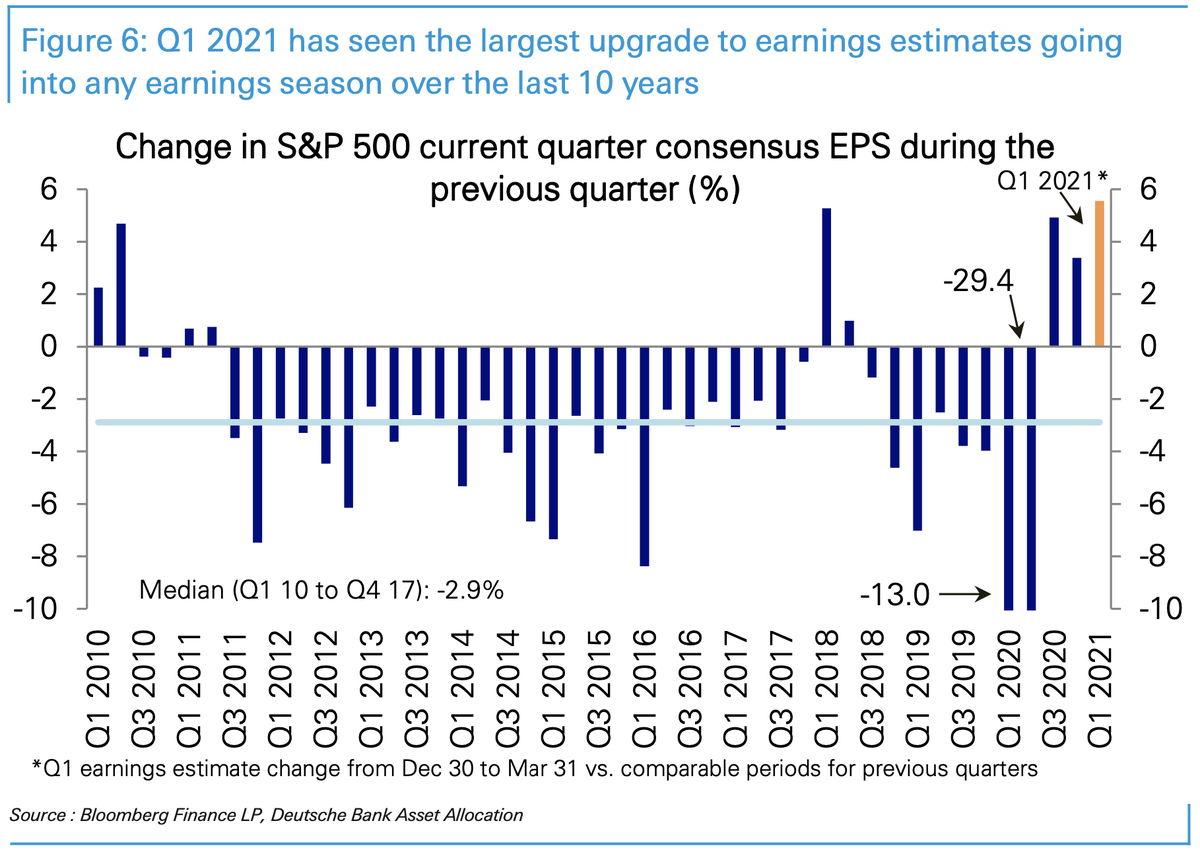

We are heading into Q1 earnings week for U.S. capital markets. According to data from Bloomberg and Deutsche Bank, the Q1 2021 earnings period in the S&P 500 has seen the largest upgrade to earnings estimates going into any earnings season over the last 10 years. Meaning, earnings announcements could be a positive catalyst for the market.

The big banks kick things off on Wednesday, with JPMorgan, Goldman Sachs and Wells Fargo reporting. On Thursday, we get Bank of America and Citigroup. Morgan Stanley reports Friday.

Gold: The U.S. dollar index had a meaningful move lower this past week (-0.91%), boosting equity and commodity prices. Gold closed the week up only +0.54%, at $1,744/oz. Following up from last week's gold vs. bitcoin chart, David Solomon, CEO of Goldman Sachs, said the following during an interview last week: “I think Bitcoin is on an inevitable path to have the same market capitalization and then higher one than gold. It’s how fast adoption is happening. Adoption is happening faster than I had predicted.”.

Kind reminder that for Bitcoin to match the market capitalization of gold, it would have to be valued at approximately 9X what it is worth today - which means roughly, ~$500,000/BTC.

DeFi: The FTX DeFi index came under some selling pressure, being down -1.59% compared to Ethereum +3.49%, and Bitcoin +3.04%. Given the prior week's price breakout, the price action could be attributed to profit taking.

In stablecoin news, China has moved on to the second phase of its CBDC trials by expanding the digital renminbi into a new region of the country. Central Banks across the world are looking at China, which is a pioneer in the CBDC space. If successful, this can have meaningful economic and geopolitical implications.

Difficulty Commentary: Not much has changed on this front since last week. The next difficulty adjustment is set to kick in this coming Thursday and should bring difficulty to a new all-time high of around 23.59TH.

Looking at the mempool, we continue to trend downwards - however, transaction times and fees should remain similar to what they have been over the last few weeks.

What's ahead for the week:

The jobs numbers last week were very strong - with non-farm payrolls rising by 916,000 in March, blowing past economists' median estimates of a 660,000 job gain. JP Morgan CEO, Jamie Dimon, predicts an economic boom that could 'easily' last until 2023. He cites that there could be 'euphoria' around the end of the pandemic.

Another interesting signal is that according to Christopher Wood, Head of Equity Strategy at Jeffries, exchanges are now holding less than 2 million Bitcoin, with this number declining every month. This means there is less supply to satisfy demand. This observation is consistent with chart below from Cryptoquant, which shows the count of inflow addresses across the exchanges it tracks. The time when most addresses receive BTC inflow, coincides with previous market cycle tops. Interestingly, BTC inflow addresses are going down in light of the recent rally.

The proposed U.S. regulation of digital asset transactions continues to be the potential curve ball for crypto markets. The commentary period for this proposed new regulation ended two weeks ago, and regulatory updates could surface any time - which could impact markets significantly.

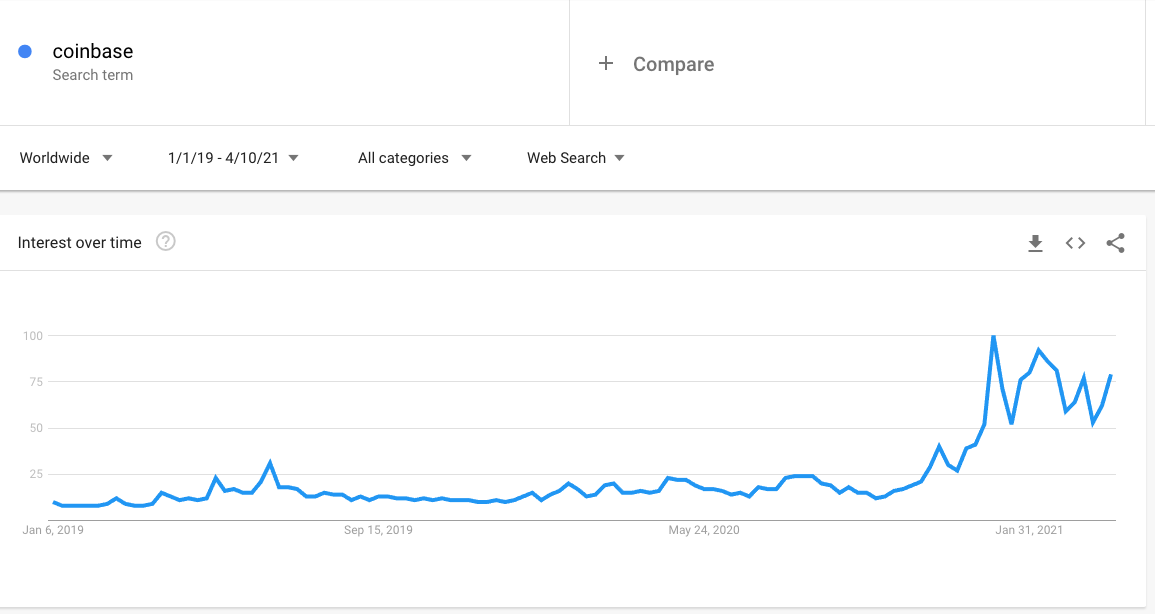

Coinbase is going public via direct listing. How will this impact bitcoin markets? A direct listing is different than an IPO in that the company is listing shares of existing investors for sale, rather than creating new shares. This is important because it creates a large liquidity event for many of Coinbase's early investors. These investors may use some of their new liquidity to invest in the sector, including Bitcoin itself. They may also use their funds to invest in the next generation of companies in the space. The key win for the industry is that even if the Coinbase listing does cannibalize Bitcoin and crypto investments (it will, in some way), the overall effect will likely be positive - as the listing will likely bring a large number of new investors, that had not previously invested in Bitcoin, to the space. This will add fresh new capital to the industry. If Google searches are any indication of retail interest, then Coinbase seems to be well poised to do so.

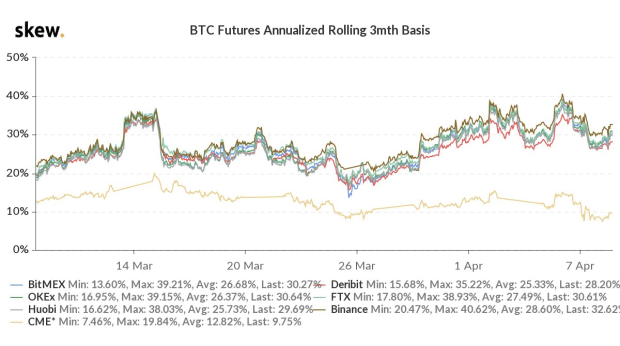

Lastly, we saw that JP Morgan published a report last week titled "Why Is The Bitcoin Futures Curve So Steep?". The report highlights the Bitcoin futures' rich premiums. We leave you with an interesting quote: “Why has such attractive pricing not simply been arbitraged away? One could perhaps blame counterparty and repatriation risk in unrelated offshore markets, but certainly not the CME. In a market with rampant bullish sentiment and heavy retail involvement it is tempting to simply blame demand for leverage. And that is certainly true to some extent. However, there are also some more idiosyncratic but equally important aspects of how these contracts are designed in the context of market segmentation that are specific to Bitcoin and likely explain a substantial fraction of this richness.” The chart below shows the annualized premiums implied in quarterly futures curves over time - showing that they have been consistently around the 20% since early March.

Big week coming up, as always, we'll keep you posted on any relevant news throughout the week right here and from our Twitter account @hodlwithLedn

Canadian Central Banking Updates:

Current Target Interest Rate: 0.00 - 0.25%

Current Overnight Money Market Rate: 0.23%

Source: https://www.bankofcanada.ca/rates/

U.S. Central Banking Updates:

Current Fed Interest Target Rate: 0.00 - 0.25%

Current Effective Federal Funds Rate: 0.09%

Source: https://apps.newyorkfed.org/markets/autorates/fed%20funds

***

This article is intended as general information only and is not to be relied upon as constituting legal, financial, investment, tax or other professional advice. A professional advisor should be consulted regarding your specific situation. The information contained in this publication has been obtained from sources that we believe to be reliable, however we do not represent or warrant that such information is accurate or complete. Past performance and forecasts are not a reliable indicator of future performance.

***