Ledn Blog

The Bitcoin Economic Calendar - Week of April 19th 2021

Examining the impact of the Coinbase listing on Bitcoin price action. Futures Open Interest reaches all-time high. Why, Doge, Why?

Not yet a Ledn client? Start earning 12.50% APY on your USDC and 6.10% APY on your first 2 Bitcoin - click here to open your Ledn account!

Follow us on social media:

The Bitcoin Economic Calendar:

Week of Monday April 19th to Sunday April 25th.

Market Commentary:

Bitcoin: Coinbase's public listing may have had a lot to do with the volatile price-action that we saw in Bitcoin last week. Let's break down what happened and shed some light on the market dynamics that led to the moves:

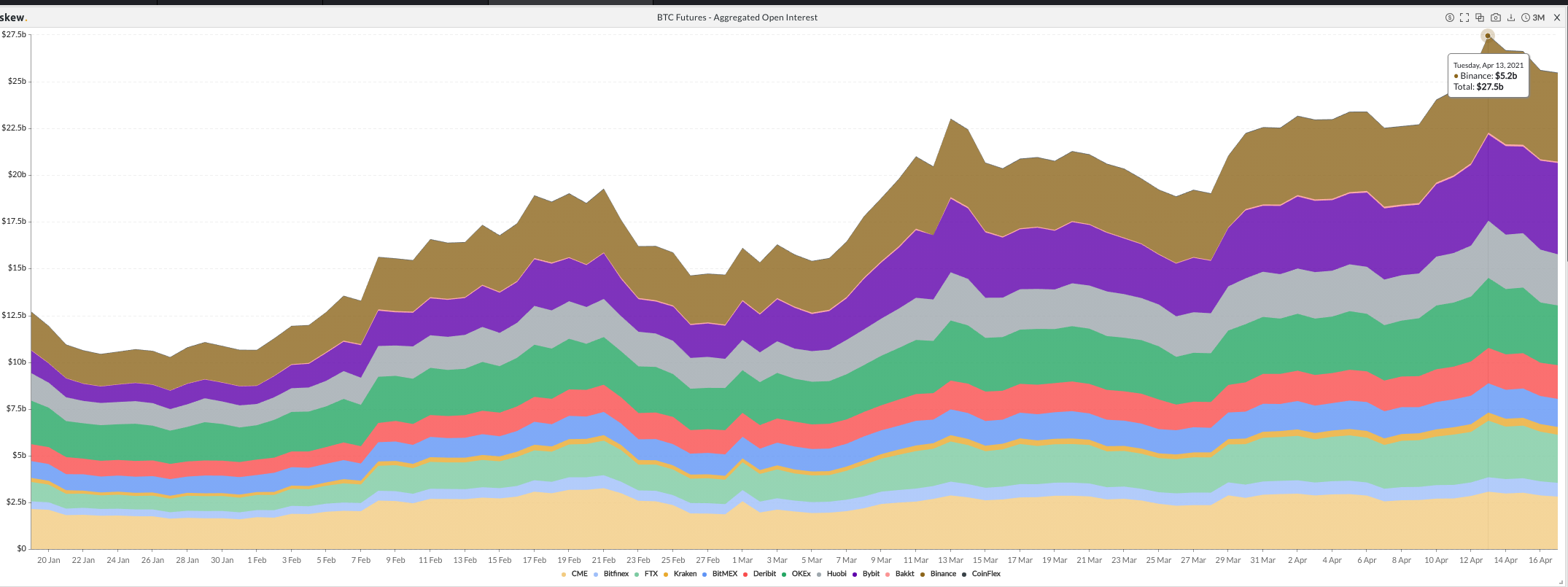

On Wednesday, the day of the listing, Bitcoin rallied to a new all-time high of $64,895, this coincided with a record volume of open interest in the Bitcoin futures market.

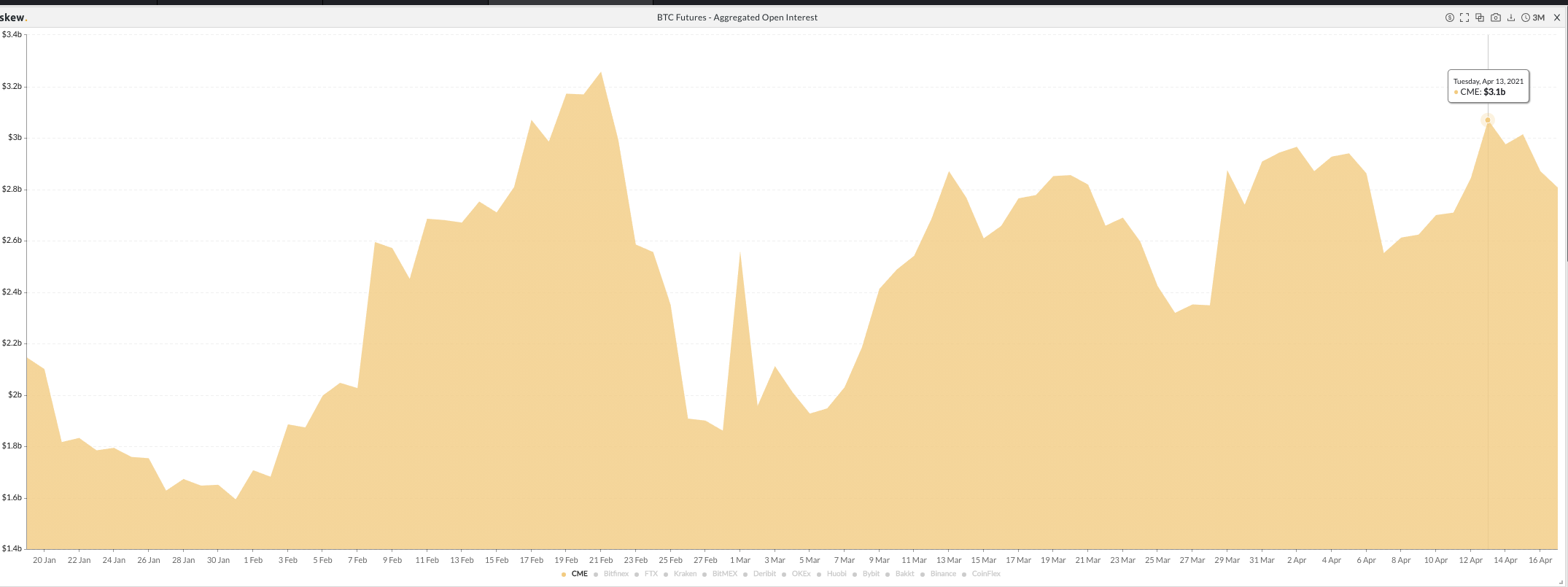

Taking a closer look, the open interest all-time highs was reached in mostly unregulated venues, and likely a factor of the implied leverage that it provides to investors - the CME did not see a new record in futures open interest last week.

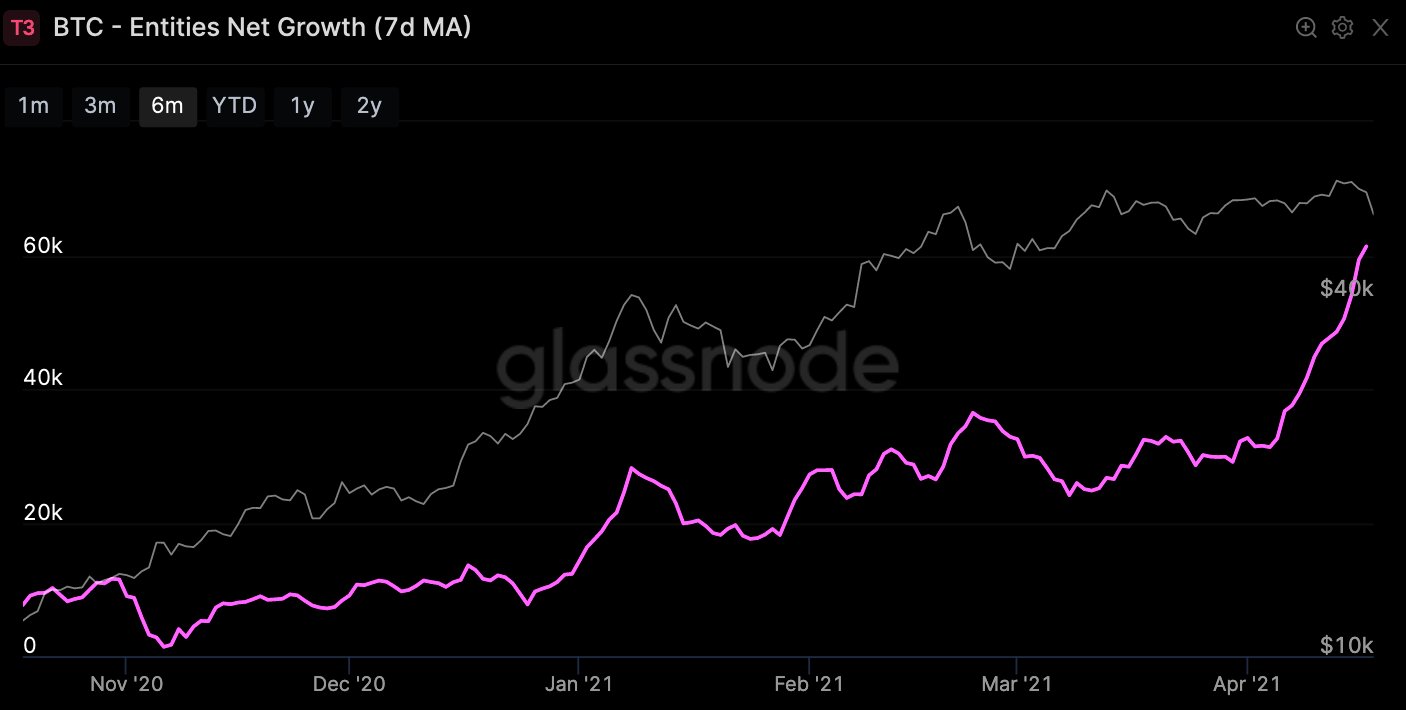

This was the first sign that the additional activity in the futures market was likely driven by retail investors - and not institutions. Second, there has been a record number of new users entering the network in the last 3-weeks, which also suggests a surge in retail participation.

To cap it off, the funding rates for Bitcoin perpetual futures swaps were very high all week (before and after the listing).

Since most individual investors around the world (namely outside of the United States) did not have access to buy Coinbase stock - they were likely driven to speculate on the price of bitcoin using excessive leverage. Yahoo reported that day traders purchased a net of $57 million in Coinbase shares on its debut on Wednesday - compare that with just one institutional investment from Kathy Wood's ArkInvest which was announced for $246 Million on Wednesday. In other words, retail participation was dwarfed by the institutional interest in Coinbase's initial listing.

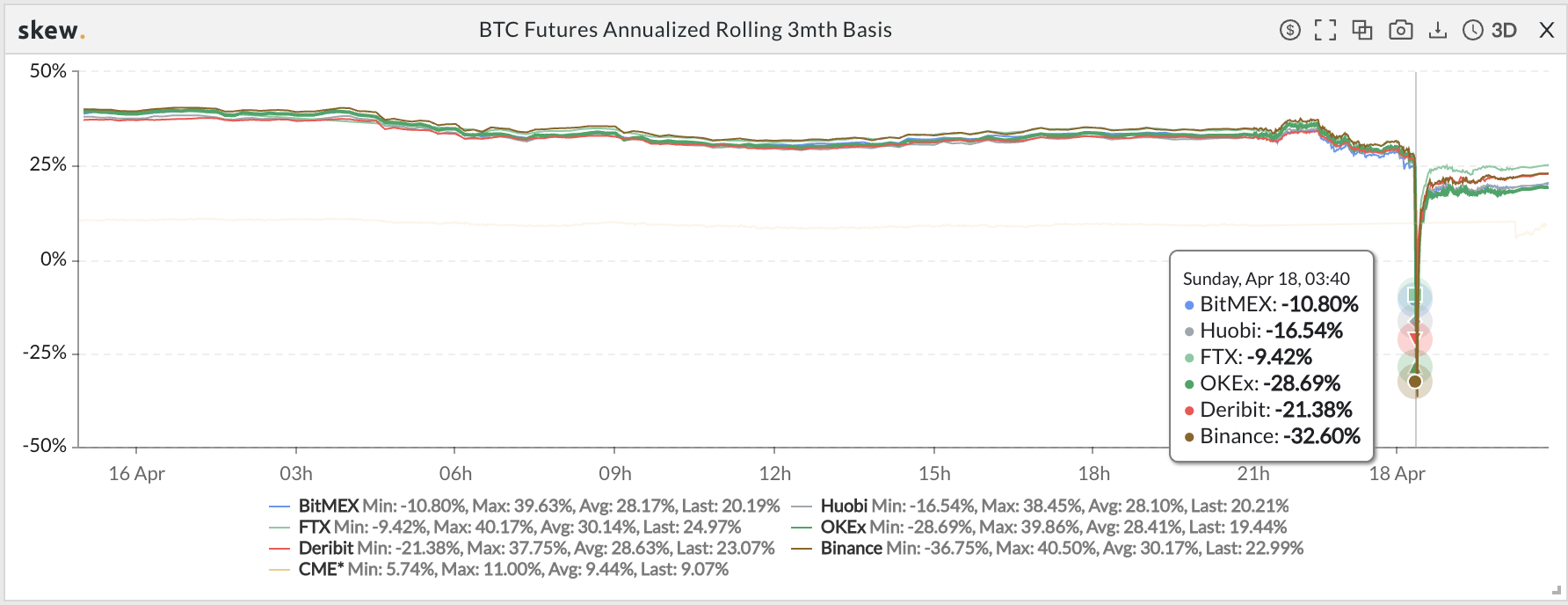

The built-up in excessive leverage on the Bitcoin futures markets led to an aggressive move downwards of -15% starting at midnight EST on Saturday and continuing overnight. This made the funding rates in most perpetual futures swaps drop significantly and even get to be negative for a short period - even the implied annualized return of quarterly futures went negative. These futures settle at par, so the only way they would stay negative for long is investors literally running out of capital to buy the future and sell the spot to hedge.

Bitcoin finished the week at $56,280, down -6.17% for the week. To put Saturday's move in perspective, the weekend move liquidated $7.6 Billion of long positions in one hour, and a total of $9.4 Billion in the 24-hour period - more than 2 times the total liquidations on March 12th, 2020. These types of moves allow investors with more conviction - and less leverage, to accumulate their long positions at a better entry point. As the dust settles around the Coinbase listing, more investors will look to make educated investments in the space. Consider the headline below from Barrons, published over the weekend:

We'll cover what we're seeing in the Bitcoin Futures, and Options front in our What's Ahead section later today.

S&P 500: Last week both JP Morgan and Goldman Sachs had blowout earnings - however, Goldman's stock barely moved higher +3.48% and JP Morgan sold off -1.98%. The major indexes still moved to fresh all-time highs, yet again - on the back of a falling U.S. dollar index -0.70% and a dropping yield on the 10-year note -5.58% to close at 1.57%. The S&P 500 closed the week at 4,183, up +1.48%. The Dow Jones also made a new all time high at 32,400, up +1.18% - and lastly, the Nasdaq moved to a new all-time high of its own at 14,041, up 1.42%.

The Russell 2000 index, which tracks small-capitalization stocks has not broken past the level that Tom Lee mentioned 2 weeks ago as his "confirmation" of a broad continuation rally. However, looking at the U.S. dollar and the yield on the 10-year note, it does seem that those 2 are losing their upward momentum and looking for continuation downwards. This could continue to provide a tailwind for equities.

Earnings continue this coming week, with some relevant ones being: Netflix (stay-at-home trade darling), and Johnson & Johnson (vaccine production update and forecasts) set to report on Tuesday, Intel on Thursday, and American Express on Friday.

Gold: We saw some interesting price-action in gold last week, moving higher by +1.81% closing at $1,775/oz. This was the largest move up in gold since December 2020. The move was likely the result of a cocktail of positive macro conditions and geo-political news.

On the geopolitical front, Reuters reported over the weekend that China started allowing its international banks to import gold in large amounts. They may be trying to strengthen their bank's balance sheets ahead of potential currency debasement. Remember, a lot of Central Banks hold U.S. dollars in their reserves, along with a select group of other currencies. If they (Central Banks) feel that the value of the dollar, or currencies in general, is poised to lose value versus hard assets like gold, this could trigger an arms race for hard assets, which could potentially include bitcoin. It will remain to be seen if these moves elicit a response from western politicians and central banks.

DeFi: The FTX DeFi index also had a very peculiar weekly candle, reaching a new all-time high intra-week, before moving significantly lower over the weekend, before settling to close up +5.79% on Sunday evening. The Coinbase listing likely affected this price-action as well.

The big story of the week in alt-coin land was Dogecoin, which soared over 400% intra week after Elon Musk once again started tweeting about it. As Meltem Demirors, founder of CoinShares, pointed out, this was likely driven by the fact that the now infamous r/WSB subreddit, the architects of the GameStop movement, started allowing cryptocurrency discussion on Wednesday ahead of the Coinbase listing. Specifically, around Bitcoin, Ethereum and - yes, Dogecoin. The move has all the makings of GameStop 2.0 - except this time there is no hedge fund to short-squeeze. It is a crowd-funded dream that, although fun to watch, will likely not have a happy ending for most. Stay safe out there.

Difficulty Commentary: We had a new difficulty adjustment kick in last Thursday which brought us to a new all-time high in difficulty of 23.58 TH. There was a big drop in hashrate over the weekend, allegedly attributed to a wide power outage in China which took down a significant portion of mining capacity. Hashrate has since levelled, showing only a -2.86% drop for the next difficulty adjustment.

The size mempool has shot back up with the increased volumes leading up the Coinbase listing and further exacerbated by the aggressive move downwards overnight. Transaction fees are elevated - which can lead to longer transaction processing times.

What's ahead for the week:

Looking at the Bitcoin Options markets, we see that the option skews for April, May and June show an interesting dynamic. April options are pricing a probability of Bitcoin being over $60k at the end of the month of just 25.85% - with that probability going up to 36.07% by the end of May and only 37.91% for June - meaning, the option markets are pricing-in a good probability that Bitcoin could remain below $60k for the remainder of April.

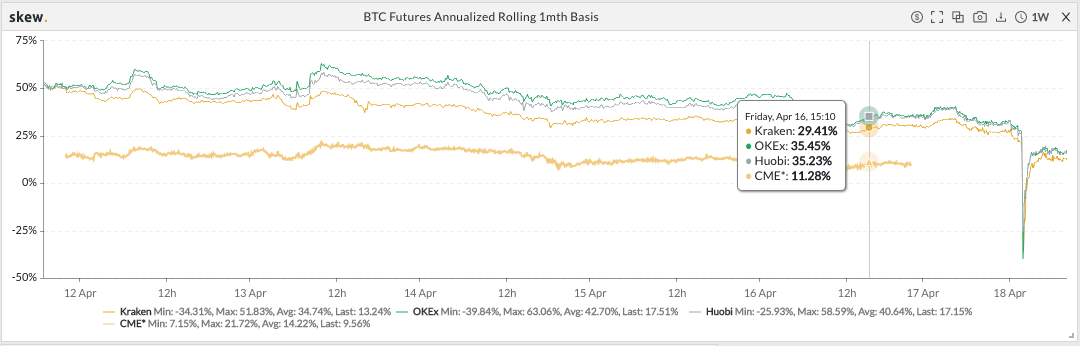

On the Futures markets front, we want to highlight two things from the chart above. First, notice the difference between the annualized implied interest on the CME (11.28%) vs. OKex (35.45%). This signals how much more institutional activity is present on the CME, as institutions would be natural sellers of futures, therefore bringing the implied yields down. Second, the annualized yields in most futures actually became negative over the weekend, which led to many over-leveraged futures positions getting liquidated - and resetting the levels down. This is healthy leading into the week as a lot of the excesses that were in the market have been "shaken out".

Taking a broader look at the markets, tail winds in equities in the coming weeks may spill over to Bitcoin - especially if the Coinbase story continues to captivate institutional investors.

Our thesis is that the Coinbase listing does two very important things to the crypto industry:

1. It cements the idea that companies in this industry can go public and be well-received by the investor community. This sets an important precedent that others will look to follow - soon.

2. It allows Coinbase and its early investors to use the proceeds of the sale to re-invest in one of the fastest-growing industries in the world - they will look to do so.

Given the improving economic conditions and amicable regulatory backdrop in the U.S., it shouldn't take long for more news to develop. To highlight the improving regulatory landscape in the U.S. - Hester Pierce, Commissioner of the SEC, is referred to as "Cryptomom" and Gary Gensler, who got confirmed as SEC Chair on the day of the Coinbase listing last week, comes from the CFTC, which is the regulatory body that oversees commodities and futures, where Bitcoin products already exist.

Big week coming up, as always, we'll keep you posted on any relevant news throughout the week right here and from our Twitter account @hodlwithLedn

Canadian Central Banking Updates:

Current Target Interest Rate: 0.00 - 0.25%

Current Overnight Money Market Rate: 0.23%

Source: https://www.bankofcanada.ca/rates/

U.S. Central Banking Updates:

Current Fed Interest Target Rate: 0.00 - 0.25%

Current Effective Federal Funds Rate: 0.09%

Source: https://apps.newyorkfed.org/markets/autorates/fed%20funds

***

This article is intended as general information only and is not to be relied upon as constituting legal, financial, investment, tax or other professional advice. A professional advisor should be consulted regarding your specific situation. The information contained in this publication has been obtained from sources that we believe to be reliable, however we do not represent or warrant that such information is accurate or complete. Past performance and forecasts are not a reliable indicator of future performance.

***