Ledn Blog

The Bitcoin Economic Calendar - Week of April 26th 2021

Biden administration reported to be developing a regulatory framework for the crypto industry. Comparing Bitcoin market cycles. What is the Fed's "reverse repo" facility?

Not yet a Ledn client? Start earning 12.50% APY on your USDC and 6.10% APY on your first 2 Bitcoin - click here to open your Ledn account!

Follow us on social media:

The Bitcoin Economic Calendar:

Week of Monday April 26th to Sunday May 2nd.

Market Commentary:

Bitcoin: On Monday afternoon, it was reported that the Biden administration was in the early stages of developing a regulatory framework for the crypto industry. Bitcoin has experienced a strong correction downwards over the last 2 weeks, dropping 26.72% from its peak (from a high of $64,895 to a low of $47,555). It closed the week on Sunday evening at $49,128, down 12.71% for the week. This has not been the case for Ethereum, which has been up both weeks, for a total gain of about ~8% over the same period.

Looking under the hood at some Bitcoin market health signals, we see a few divergences:

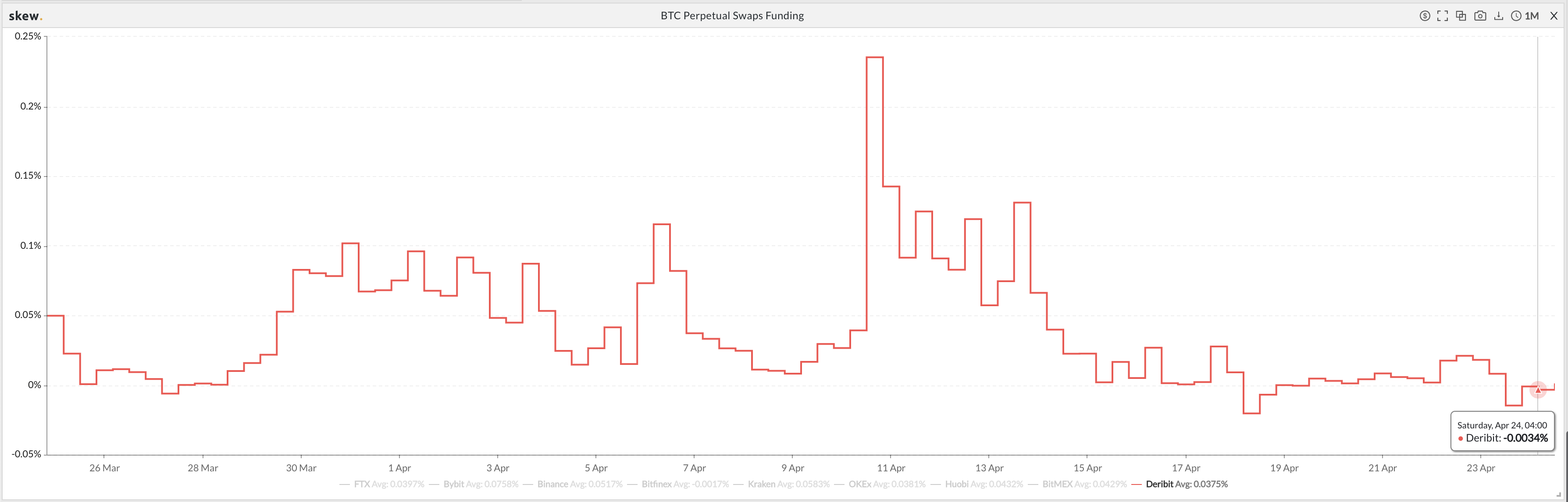

The perpetual swaps funding rates for Bitcoin are now back to normal levels, after having slipped into negative territory over the weekend on platforms like Deribit. This is a healthy sign of deleveraging. However, it is not the only indicator of leverage in the system.

The perpetual swaps funding rates for Bitcoin are now back to normal levels, after having slipped into negative territory over the weekend on platforms like Deribit. This is a healthy sign of deleveraging. However, it is not the only indicator of leverage in the system.

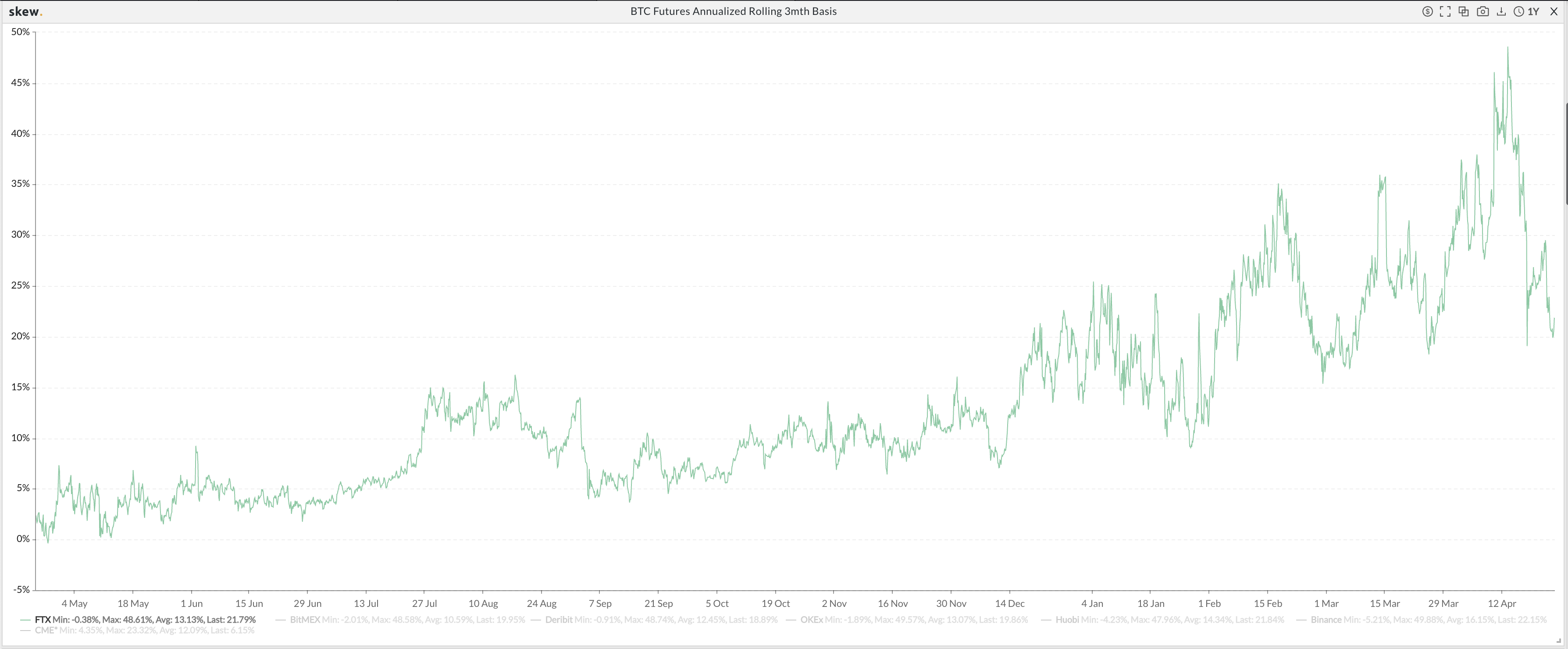

The implied annual yield on the Bitcoin futures on a rolling 3-month basis, even after more than halving from 47% to the current 20%, it is still above the it's historical mean of around 15%. This suggests that there may still be some deleveraging to go - meaning we could potentially head lower or trade sideways for longer.

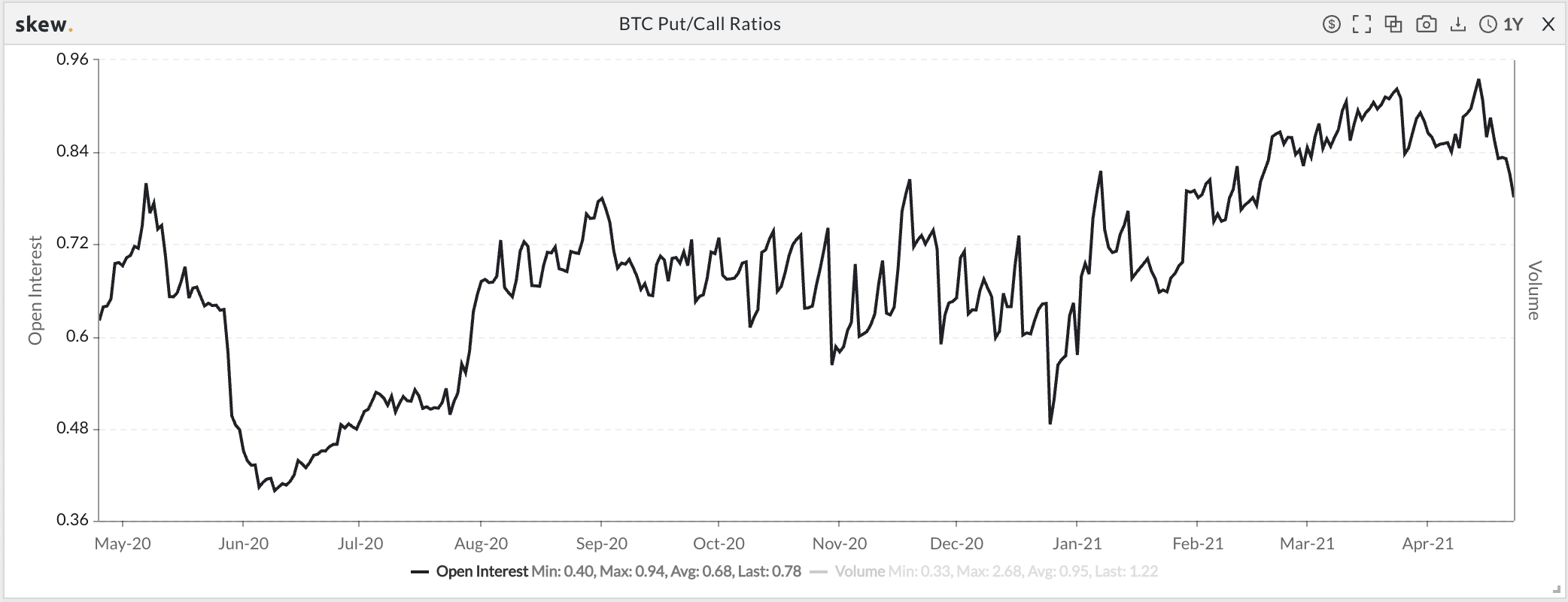

The Put/Call ratio for bitcoin options, which tracks the relationship between Put contracts (usually bought to hedge downside) vs. Call contracts (usually bought to speculate on upside), is still at 0.78 - which is at the top of its historical trading range for the year. Again, this suggests that there is still significant interest from investors to hedge their downside - relative to the levels where it has traded for the last 12 months.

The Put/Call ratio for bitcoin options, which tracks the relationship between Put contracts (usually bought to hedge downside) vs. Call contracts (usually bought to speculate on upside), is still at 0.78 - which is at the top of its historical trading range for the year. Again, this suggests that there is still significant interest from investors to hedge their downside - relative to the levels where it has traded for the last 12 months.

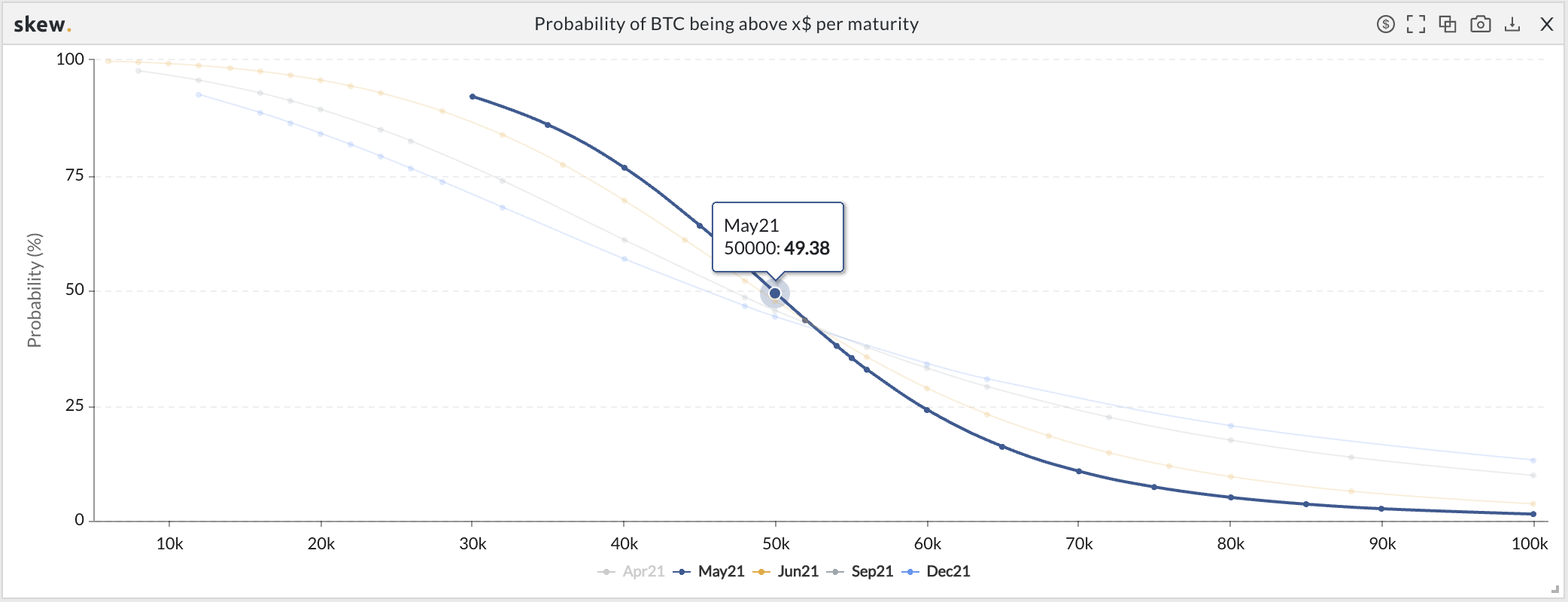

Lastly, the Bitcoin options contracts from May to December 2021 were all pricing a lower than 50% probability of Bitcoin being above $50k by maturity, as of Saturday (April 24th).

Lastly, the Bitcoin options contracts from May to December 2021 were all pricing a lower than 50% probability of Bitcoin being above $50k by maturity, as of Saturday (April 24th).

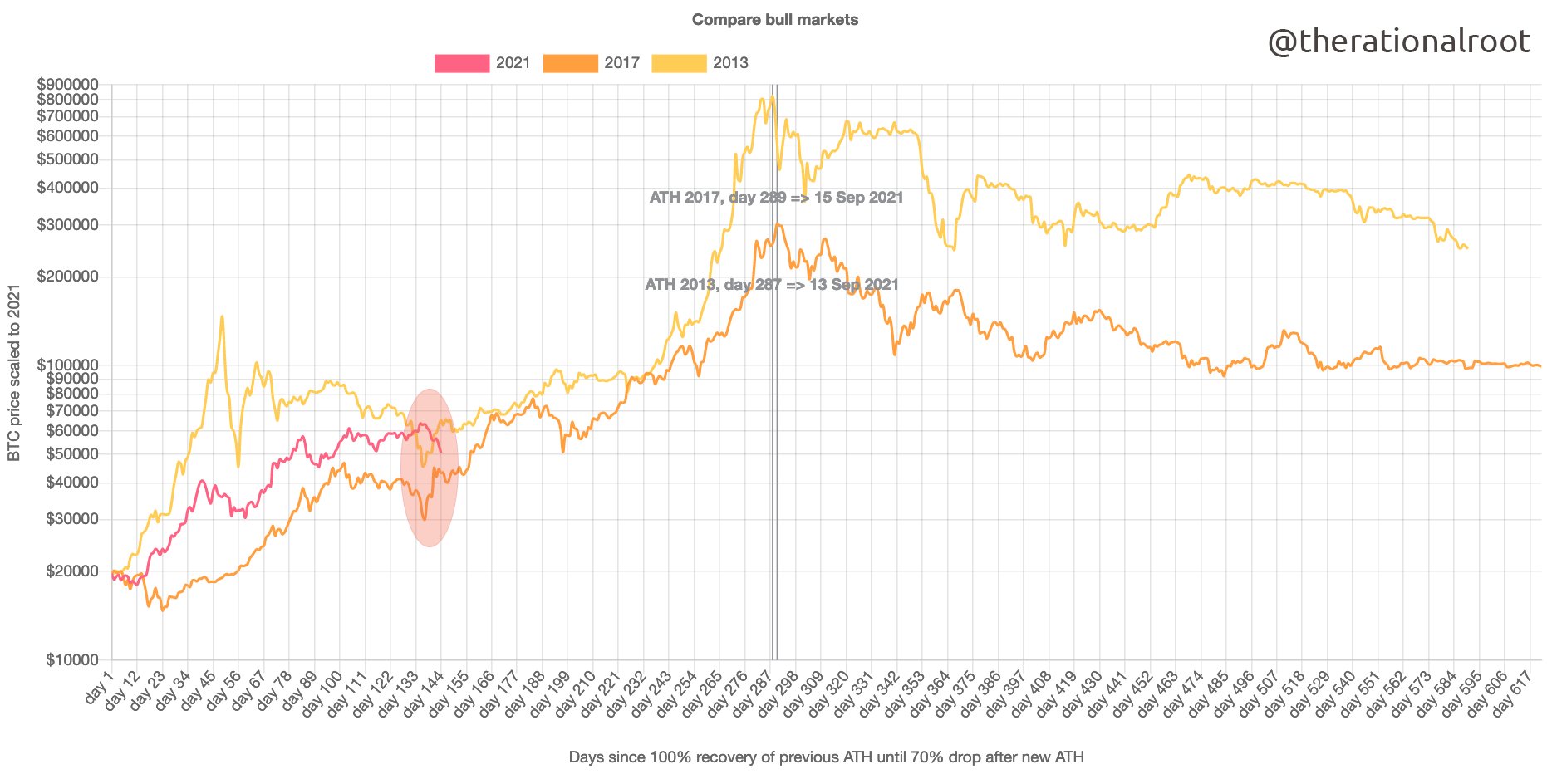

While these short-term market indicators may not look too favourable, the long-term picture for Bitcoin certainly does. The current drop is very similar to those experienced in previous bull-market cycles.

As per the chart above, if this cycle is anything like the previous ones, we are about 150 days from reaching the "all-time" high for the current cycle. That date, based on previous cycles, would be projected for mid-September 2021.

S&P 500: Equity markets had a wobbly week on the back of mixed earnings and headlines about a potential new Capital Gains tax in the U.S. A weaker U.S. dollar (-0.86%) during the week was almost enough for the S&P to make up for it, but it ended the week just below the previous weekly close, down -0.18% at 4,175 points. The Nasdaq and the Dow Jones also closed slightly lower for the week, at -0.72% and -0.46% respectively.

For the most part, U.S. corporate earnings seem to be living up to their expectations, and that is consistent with the view that asset prices (like equities) could continue rising. A very interesting signal in the markets is the fact that U.S. mortgage equity withdrawals have reached 2006 levels again.

While this may look alarming at first glance, it is actually the behaviour that you'd expect from a rational investor in the current environment. Americans are borrowing against the rising value of their homes to take advantage of rock-bottom interest rates and soaring property values. They are most likely to re-invest in hard assets (more real estate and/or equities), whose prices should appreciate above their borrowing costs in the coming years. For context, the rate for a 10-year mortgage in the U.S. is ~2%, and a 30-year fixed mortgage is at ~3%. Consider that the Fed has openly stated that it wants inflation to be above 2% for a considerable time in the near future so that it averages 2% over the long-run. This chart, which shows dollars borrowed, does not paint the entire picture. There have been trillions of new dollars pumped into the economy, which has caused property prices to soar. A better metric to look at would be percentage of property value that owners have borrowed.

The Fed has openly stated it does not plan to raise rates any time soon. In addition, there is a lot of cash in the system, and that puts even more downward pressure on rates. The Fed is having to do some creative adjustments to soak up the excess cash in the system and prevent banks from being tempted to lend it at negative rates. We'll cover this in our What's Ahead section later today, along with the Big Tech companies that are reporting this week.

Gold: Flat week for gold, ending the period up +0.07% at $1,777/oz. Even a down week for the dollar and the news out of China last week were not able to move it higher. There were no major catalysts for gold this week - however, we have an FOMC meeting this week. We'll discuss potential implications in our what's ahead section later today.

DeFi: Tough week for the DeFi index, finishing the week down -8.85%. Ethereum finished the week at $2,321, up 3.58% after touching a new all-time high of $2,645 intra week.

There were some headlines around SafeMoon, a DeFi coin built on top of Binance Smart Chain. It went up 4X before halving over the course of the week. Binance Smart Chain continues to find ways to grab headlines and get developers to build on top of it. For a quick update on Doge: it ended up the week down 14.4% after touching a high of $0.43.

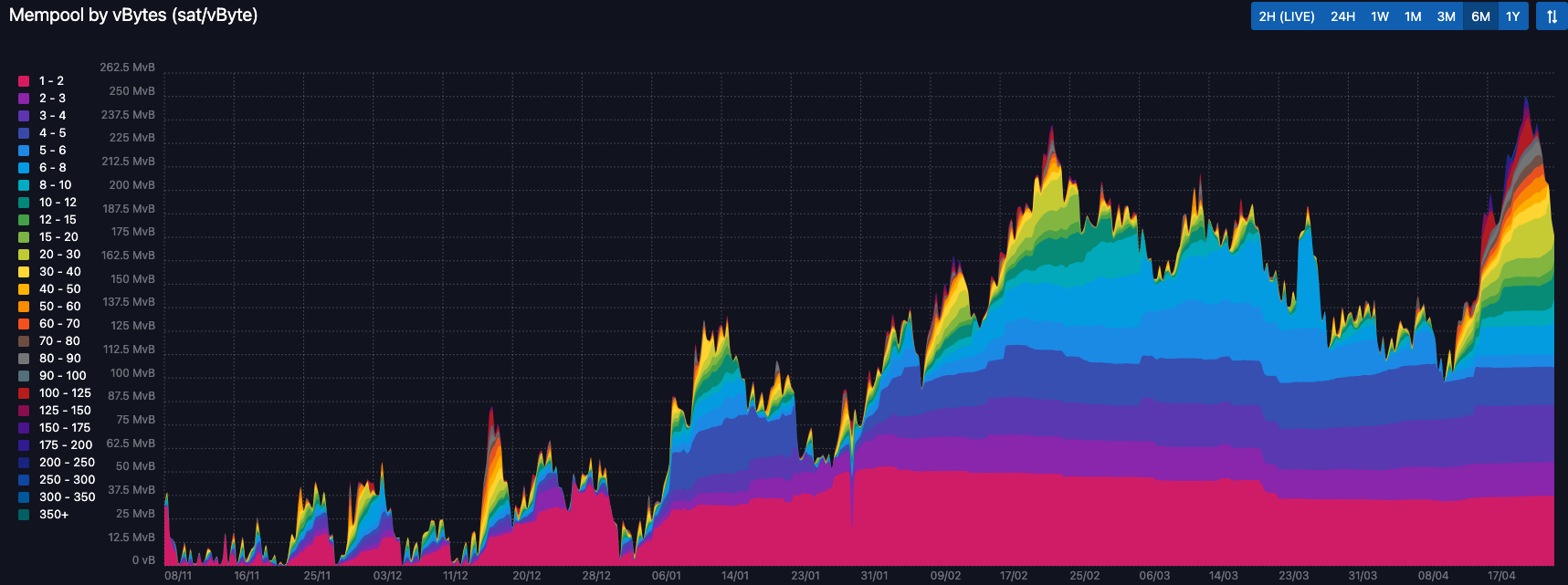

Difficulty Commentary: After soaring last weekend and remaining congested throughout the week, the size of the mempool has come down considerably over the weekend.

Transaction costs peaked at ~250 sats/vbyte last week for a quick confirmation. We are now at levels of around 60 sats/vbyte to be included in the next block. While this is still very high - it is about 4X cheaper to transact than it was last week. The next adjustment is scheduled for this Saturday and should bring difficulty down ~9.5% - which will speed up the time between mined blocks and should help unclog the network further.

What's ahead for the week:

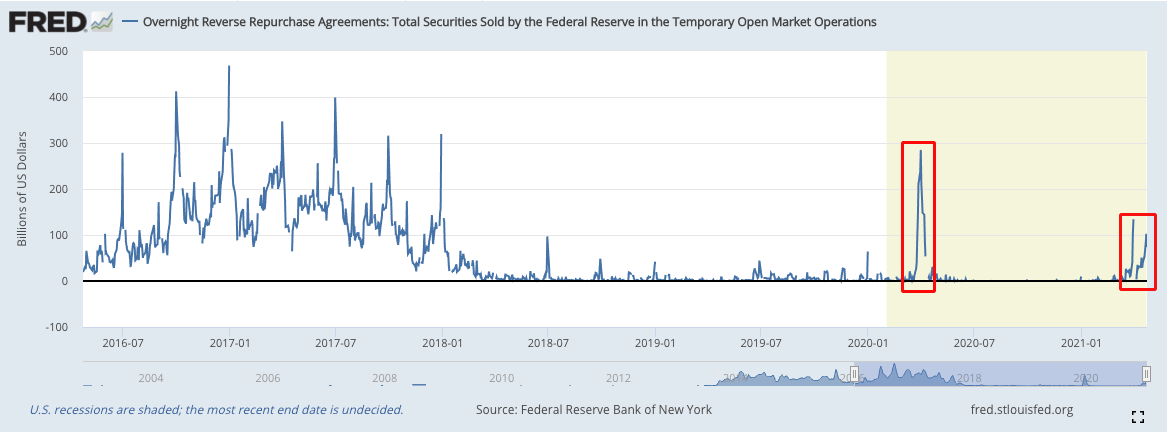

The Federal Reserve will hold its April Federal Open Market Committee meeting this Tuesday and Wednesday. While the market does not expect any major surprises, they will very likely address the recent activity in the Reverse Repo market. We will talk about what that is and why it matters shortly.

This week is loaded with Tech earnings, which could act as a boost to the sector. Google and Microsoft report on Tuesday and are expected to report year-over-year revenue growth of 25% and 17% respectively. Apple reports on Wednesday with data indicating that app spending has increased 40% in Q1 2021. Facebook also reports on Wednesday with analysts expecting a 33% increase in revenue from a year ago. Amazon reports on Thursday with analysts expecting its results to be 33%-40% better than last year. Lastly, Twitter also reports on Thursday with its revenues expected to be 26.5% better than the same quarter last year.

As corporate earnings continue to impress, and the U.S. dollar index seems to be picking up steam on the way down, the above chart by Lyn Alden is prescient. Her view is that strong earnings cycles tend to coincide with bear market cycles for the U.S. dollar. Looking at recent indicators and price action, it does feel that we are starting to head in that direction. Bear markets for the U.S. dollar are also a tailwind for equities, commodities, and asset prices in general. Overall, this would be a very positive backdrop for assets like bitcoin.

Perhaps this is what the Biden administration is anticipating, and why it is signalling early on that it plans to do something about capital gains taxes. These taxes only apply to investors who want to realize profits on their asset purchases by selling their assets and crystallizing their profit. As we learned from the S&P 500 section above, savvy investors don't sell from their assets - they borrow against them to buy more assets. Borrowing from your assets is not a taxable event in most jurisdictions and you can get liquidity to diversify your portfolio. This, among other reasons, is why investors are using up all the debt capacity in their home investments, and also why Bitcoin-backed loans have soared in popularity this year.

Now to the Fed's reverse-repo facility. As we can see from the chart above, the New York Fed has been getting active in this market again.

What is the reverse repo market? When banks have excess cash, they need somewhere to put it to work. The Repo market (where banks lend cash to each other using primarily U.S. treasuries as collateral), is typically very active. There are times when there is so much cash in the system that the banks will actually pay to borrow the 10-year treasury note (to be short it), and that creates a negative interest rate in the repo market. To prevent this, and discourage negative rates in the repo market, the Fed enables the New York Federal Reserve Bank to lend these treasuries at 0% (and borrow the cash to take it out of the system).

At a high level, you can think of the reverse repo facility at the New York Fed as the sponge that soaks for all the excess cash available and prevents it from being lent at a negative rate. As you can see, this facility is quickly rising and nearing the $100 billion mark. It is likely to keep growing.

Big week coming up, as always, we'll keep you posted on any relevant news throughout the week right here and from our Twitter account @hodlwithLedn

Canadian Central Banking Updates:

Current Target Interest Rate: 0.00 - 0.25%

Current Overnight Money Market Rate: 0.23%

Source: https://www.bankofcanada.ca/rates/

U.S. Central Banking Updates:

Current Fed Interest Target Rate: 0.00 - 0.25%

Current Effective Federal Funds Rate: 0.09%

Source: https://apps.newyorkfed.org/markets/autorates/fed%20funds

***

This article is intended as general information only and is not to be relied upon as constituting legal, financial, investment, tax or other professional advice. A professional advisor should be consulted regarding your specific situation. The information contained in this publication has been obtained from sources that we believe to be reliable, however we do not represent or warrant that such information is accurate or complete. Past performance and forecasts are not a reliable indicator of future performance.

***