Ledn Blog

The Bitcoin Economic Calendar - Week of January 11th 2021

Monster week for Bitcoin - new levels to watch. Why did the U.S. Dollar and Equities rally together last week? Ledn Platform Updates!

Not yet a Ledn client? Start earning 12.25% APY on your USDC and 6.25% APY on your Bitcoin - click here to open your Ledn account!

Follow us in social media:

The Bitcoin Economic Calendar:

Week of Monday January 11th to Sunday January 17th.

Market Commentary:

Bitcoin: Impressive, yet volatile week for Bitcoin - closing at yet another weekly all-time high of $38,171. The road there was very bumpy - as we had written about in last week's issue, the effects of the new levels of leverage and increased retail/speculative activity are certainly being reflected on the price action. Bitcoin touched $42k during the week, then went on to visit levels as low as $34.5k before settling to close the week at $38,171 for a gain of 15.39%.

We are seeing a continuation of Bitcoin asserting itself as an institutional-grade investable asset. The narrative of Bitcoin as sound money and institutional adoption is strengthening everywhere you look. For illustrative context, let's look at some of The Economist's headlines about Bitcoin over the last 2 years:

27/03/2019: "Can cryptocurrencies recover? Flaws in Bitcoin make a lasting revival unlikely. The latest boom and bust invite comparisons with past financial manias"

29/10/2020: "Getting down with the cool kids on bitcoin - How investors might learn to stop worrying and love crypto"

09/01/2021: "Cryptocraze: Is the financial establishment coming round to bitcoin Some financiers see the cryptocurrency as a hedge against inflation"

As we can clearly see from the headlines above, the narrative around Bitcoin has changed dramatically. Elsewhere in the investment community we see even more signs. The StoneRidge 2020 Shareholder letter was a tour-de-force on the concept of money, how Americans take the hegemony of the U.S. dollar for granted, and how Bitcoin represents a potential monetary revolution that cannot be ignored. For context, Stone Ridge is an institutional asset manager with over USD $13 Billion under management.

On-chain activity is consistent with more institutional accumulation. The aggregate number of bitcoin in addresses holding over 100 BTC hit its highest level all year, 11.46 million bitcoin. Additionally, the number of addresses with balance of more than 100 bitcoin surpassed 16,300—a level we had not reached since March 16, 2020.

It is very likely that we will continue to see announcements from institutions in the coming weeks and months,. We'll talk about what we can expect for Bitcoin this week in our What's Ahead section - but we can certainly expect more turbulence and price volatility in the week ahead.

S&P 500: Last week's politically charged events led to some very interesting market behaviour. Firstly, the index's gains- relative to last week's record high - all came after the dramatic events of January 6th. The S&P closed at a record 3,824 points, up 1.83% for the week. As we've written about here before, there is a historical inverse correlation between the U.S. dollar index and the S&P 500. As a refresher lets look at the chart below:

Now, after the unfortunate events of January 6th, it became more clear that there would be a transition from outgoing president Trump on January 20th. If we zoom into the behaviour of both the S&P 500 and the market, we see something very unusual: from January 6th onwards _both_ the dollar index *and* the S&P500 rallied.

From a market perspective, what this illustrates is that there is demand for both U.S. Dollars and U.S. equities at the same time. This could mean that the recent political events made investors feel more comfortable about the political transition in the U.S. presidency. One theory is that investors that were hedging a potentially challenged presidential transition by investing in foreign markets may be unwinding their positions and rotating them back to the relative safety of the U.S. dollar and its equity markets. The week ahead may quieter than usual, as the outgoing president has been banned from essentially all social media platforms. Although this will likely lead to a smoother transition and cooler tempers, it will inevitably spark a debate around platform censorship of political content and whether they are to be considered publishers in that context. It will be very interesting to see how stocks like Facebook and Twitter react in the coming week.

Separately, we are starting to see some bearish calls from analysts like Citi, JP Morgan, and Bank of America for U.S. equities - we'll talk more about this in our What's Ahead section.

Gold: Gold didn't have the same luck as equities or Bitcoin - it had a horrible week, particularly on January 6th and onwards - it dropped 1.63% on the 6th, 0.25% on the 7th and a dramatic 3.38% on the 8th to close the week at 1,848/oz down -2.61%. At this stage it is starting to become clear that Gold is starting to lose its allure around portfolios relative to Equities, Bitcoin, and seemingly dollars this week - although large dollar positions are very likely "transitionary" and will be looking to get redeployed. While it is unlikely for gold to have a "fall from grace" - it will very likely face some head winds going forward relative to Bitcoin and global equities.

DeFi: If there was one word to describe the alt-coin markets right now it would be euphoria. Ethereum has soared over USD $1,300 and closed the week at $1,255 - and we saw the DeFi index outperform the protocol level assets to the upside for the first time since we began covering the index here. Not only did it outperform to the upside, but it broke its all-time high as well to close the week up 30.19% vs Ethereums 28.09% and BTC's 15.39%. Keep in mind this is in the context of the potential regulation of the U.S. outlawing all services that do not conduct KYC - which should be out in days or weeks.

As we have written about extensively here - this as a potential sign that the market may be reaching a local "organic" top and moves can be very unpredictable and volatile. Price action in alt-coins is a great indicator that speculation is taking over the markets and that the moves may start to defy gravity and logic (at times). It is very important to proceed with caution in these market conditions as some volatility will certainly spill into BTC price action. We will continue to monitor the relationship between this index and the protocol level assets.

Ledn Updates: Introducing Safelisting

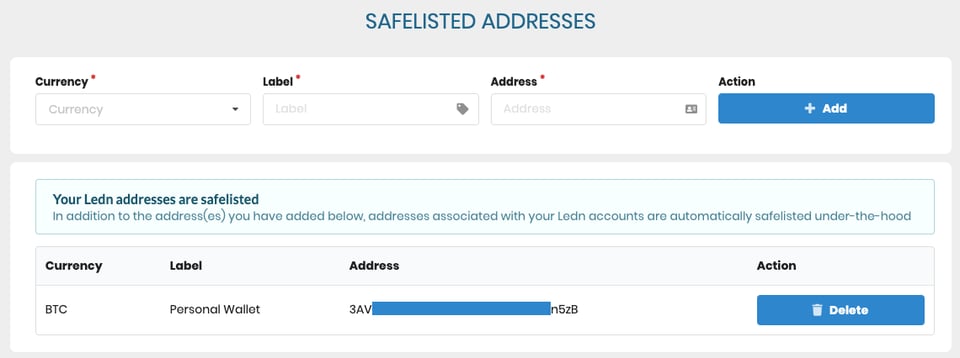

We are proud to announce the release of our Safelisting feature for the added security of our clients. The Safelisting feature allows clients to pre-aurhotize destination addresses for withdrawals and once activated, withdrawals will only be allowed to safelisted addresses.

Important things to know:

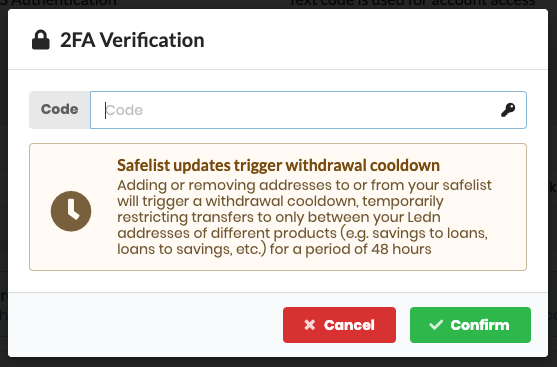

1. You must have your Token 2FA Authenticator enabled to enable the Safelisting feature.

2. 48-hour cool-off period: When you first set-up a safe-listed address, the system will automatically start a 48-hour cool-off period during which withdrawals will be restricted. This will not impact any withdrawals that you wish to make to any other of your active Ledn products.

For further clarity, every time you wish to add a new address, there will be a 48-hour cool-down period before being able to send BTC or USDC to that address.

Deleting addresses will also trigger a 48-hour cool-down period.

2. Transfers from BTC Savings to Ledn Loan addresses for collateral top-ups: All your Ledn product addresses will be automatically safe listed. For example, if you have active Bitcoin-backed loans or B2X loans, the collateral top up bitcoin addresses for all active loans will be automatically safelisted and always remain available for you to send BTC to - even during the cool-down periods.

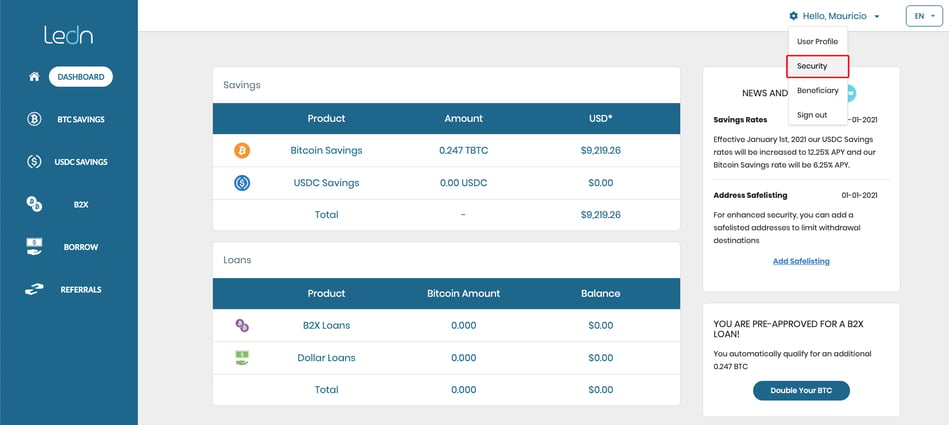

How to activate Safelisting:

1. Once logged into your dashboard, navigate to the "Security" section on the top right corner of your screen:

.png?width=960&name=Screen%20Shot%202021-01-10%20at%202%20(1).png)

3. Once you have clicked the "Add" button, you will be prompted to confirm the details and enter your Token 2FA code. You will also see a notice that the 48-hour cool-down period will start from the moment you submit the instruction to safelist a new address:

And that's it. After the 48-hour cool-down period passes, your account will only be able to withdraw funds to Safelisted addresses.

Keep in mind once again that you will _always_ be able to send Bitcoin from your Savings Account to any active loan collateral address for top ups.

Additionally, for the peace of mind of our clients, we will be maintaining our video-call confirmation requirement for withdrawal for amounts in excess of USD $100,000 or its BTC equivalent - even if the addresses are Safelisted.

Difficulty Commentary

A massive upward difficulty adjustment came into effect on Saturday instead of the usual Sundays (last week we mentioned it may happen sooner than expected because of how much hashrate was coming into the network). The adjustment brought us to a new difficulty all-time high of 20.61 TH, 10% higher for the period - and *so much* hashrate has continued pouring into the network that the next adjustment is projecting another 12% increase to 22.93 TH. This was to be expected, as we mentioned in our December issues, and will likely only accelerate.

What's ahead for the week:

Although we are likely to see a politically charged week in the U.S., recent market activity reflects that investors seem to be at ease with the fact there will be a transition of power come Jan 20th. This may result in more investments coming into the U.S. and momentarily causing the dollar weakness to take a breather before continuing on its way down. Let's bear in mind that the Fed's trade-weighted dollar index, which we've covered here extensively, is still at 111 as of Dec. 31st - and they very likely want that number to get as close to 100 as possible - that's another 10% drop on the greenback. Layer that with the fact that the 10-year U.S. Treasury yield is rising - which the Fed wants, but the flip side is that it makes borrowing costs for U.S. companies higher, which may present some headwinds. This may be behind the reasoning on analysts like Citi are cutting U.S. equities to neutral and favouring Emerging Market equities. We'll dive deep into U.S. inflation dynamics on the next issue.

As far as Bitcoin goes, we are starting to see some heavy option activity around the $36k strike in the January 29th expiration. While this doesn't necessarily mean that the price is heading there, the sheer size of the contracts makes it very unlikely that it is a retail or individual position. It is a large position in a sophisticated market so one can assume that there are 2 very well-informed market participants who believe that is a very important price level. The CME Futures curve is flat from March and April in the mid $38k levels - which is a tight range considering the option strikes for late Jan. Something to keep in mind.

As we mentioned above, the level of retail and speculative participation will introduce a lot of volatility into the markets. Google search trends are already showing 100 for Bitcoin and "Crypto". The fact that alternative coins are outperforming Bitcoin, which is the only digital asset institutional investors are actually pursuing, is a clear sign that volatility will remain for a while. Be safe out there!

As always, we'll keep you posted on any relevant news throughout the new year right here and from our Twitter account @hodlwithLedn

Corporate Earnings

No relevant earnings for Bitcoin this week.

Canadian Central Banking Updates:

Current Target Interest Rate: 0.00 - 0.25%

Current Overnight Money Market Rate: 0.23%

Source: https://www.bankofcanada.ca/rates/

U.S. Central Banking Updates:

Current Fed Interest Target Rate: 0.00 - 0.25%

Current Effective Federal Funds Rate: 0.09%

Source: https://apps.newyorkfed.org/markets/autorates/fed%20funds