Ledn Blog

The Bitcoin Economic Calendar - Week of January 18th 2021

Earnings Season & a new President this week in the U.S. - implications for Bitcoin. Examining double-digit inflation in desirable assets.

Not yet a Ledn client? Start earning 12.25% APY on your USDC and 6.25% APY on your Bitcoin - click here to open your Ledn account!

Follow us in social media:

The Bitcoin Economic Calendar:

Week of Monday January 18th to Sunday January 24th.

Market Commentary:

Bitcoin: Last week Bitcoin saw its first down week in over a month, closing at $35,820 down -6.16% for the period - even in the context of very favourable news-flow. During the week we saw industry-related headlines from none other than the Federal Reserve and Goldman Sachs.

On Thursday, the Fed's Jerome Powell said that "Stablecoins are a high priority" and that they are looking at it very carefully. They understand stablecoins can "become systemically important overnight" and they want to get their arms around the potential risks and how to manage them. However, he did mention that they want to do this "right, rather than quickly" and that the time to any action would be measured in "years, not months". It is interesting that the Fed is now paying attention to stablecoins - and even more interesting that they want to "get it right".

Separately, on Friday - Coindesk reported that Goldman Sachs is said to be planning to enter the Crypto market soon with a "custody play". It also mentioned that JP Morgan and City are also looking into it as well. The Goldman Sachs source in the article also said that the firm does not have grandiose plans for Crypto Prime Brokerage like the ones that Coinbase, BitGo and Anchorage have.

Bitcoin and Ethereum being down on the same week as these news illustrates how much noise and speculative action is in the markets at the moment. We'll discuss what the options markets are showing for Bitcoin's January 29th expiration along with the futures markets in our Whats Ahead for the Week section below.

S&P 500: Last week the S&P 500 gave back -1.48% to close at 3,768 - just 4 points away from where it opened the week prior (3,764). In other words, the S&P is essentially flat over the first 14-day period of 2021. With so much going on this coming week, it makes sense that the market would take a breather. We have a decisive week ahead for U.S. equities with the start of Q4 earnings season. Throughout the week we get to hear from some large banks like Goldman and Bank of America, and some tech darlings - we cover them in detail in our what's ahead section below, but we will keep an ear out to see if any of the bank's earnings calls mention Bitcoin this time around. Silvergate is scheduled to report, which will certainly highlight Bitcoin in its report.

As we'll cover in our Market Trends section, the price to earnings ratio of the S&P has been expanding dramatically over the last year - and this earnings season can be a catalyst to either compress or expand those multiples based on results and guidance. Last, but certainly not least, there's the inauguration of President-elect Joe Biden on Wednesday, which should be a momentous occasion in the United States. President Biden is already working on a $1.5 T spending program to stimulate the economy - so once the celebration is over, investors' attention could potentially go right back to stimulus spending, which - as we have seen, has driven the markets higher on the narrative of potential future inflation.

Gold: Gold was also down last week along with Bitcoin and U.S. equities, but it held up a bit better to the down side - giving back only -1.13% to close at $1,827/oz. Similarly to U.S. equities and Bitcoin, investors are potentially awaiting some of the decisive events from this week to help drive further investment decisions. The next catalyst for gold could be the fiscal stimulus discussion that will certainly arise after Biden's inauguration in the coming weeks. We'll see how gold performs relative to Bitcoin to the upside if this does pan out. Furthermore, it is interesting to note that Gold, U.S. equities and Bitcoin are all down last week - and as we'll see below, DeFi and highly speculative tokens were all up. These market dislocations are important to look at, because they can tell us a lot about current dynamics and behaviour.

DeFi: Euphoria has squarely taken over the alternative coin markets. DeFi soared 31.11% in a week when:

- Bitcoin (-6.16%), U.S. Equities (-1.48%), Gold (-1.18%), and even Ethereum (-1.75%) were all down.

- Andre Cronje, the godfather of DeFi and fair launches, and creator of YFI, published a piece literally titled "Building in DeFi sucks" - which went on to say that he had made many mistakes and did not suggest other founders follow his path. For context, Andre's YFI concept was largely responsible for triggering the previous rally in DeFi.

- A law from the U.S. Treasury is days away from potentially outlawing any services that do not properly KYC their users - which is basically all of DeFi.

All of this should make investors take a pause and deeply consider the market conditions we are in. While we are not trying to discard every single DeFi project as valueless - given the recent market activity, there is little reason to believe that the recent price run ups are long-term investors who truly believe in the world-changing potential of DeFi. Have you read a single institutional investor thesis as to why they are allocating investment dollars to DeFi? Neither have we.

All of this could translate into continued volatility for Bitcoin and digital assets in general for the weeks to come.

Double-digit Inflation in desirable U.S. Assets

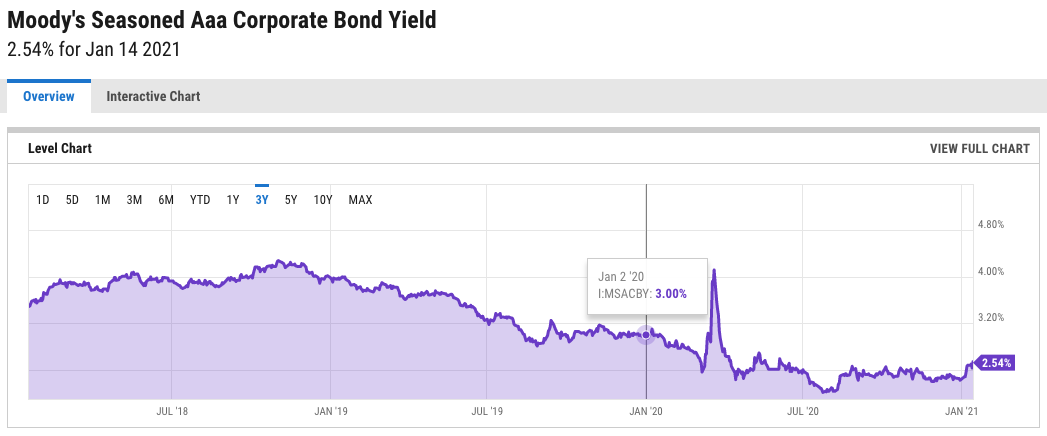

The price of a $120,000/year retirement cash flow through AAA Corporate Bonds

Price to Earnings ratio of U.S. Equities

As we have covered here recently, the S&P 500 index has made new historical highs over 2020 and recently in 2021. While the index itself increased from 3,257 to 3,700 points, or 13.59% over the course of 2020, this does not tell the whole story. If the prices of shares went up by 13.59%, then that means that companies, in general, should be making about the same more in profits - therefore making them more valuable. To see whats really happening, we need to look at the earnings that they are generating.

When we look at the Price to Earnings ratio of the shares in the index (divide the price of the share by the annual profits per share for the company), we see a very different picture. The PE Ratio for the S&P 500 as calculated by the Case Shiller index, pictured above, shows that the PE ratio for the S&P 500 has gone from 24.21 to 37.85 during the course of 2020. This means that the price of the index has risen despite the earnings for the underlying companies not having grown, and in some cases, earnings have even gone down. The PE ratio for the S&P500 has expanded by 56.34%. This is more than 4x the rise in the index, and over 30X the increase of the CPI.

Price of Luxury Real Estate in The Hamptons

To illustrate inflation in U.S. real estate, the best example can probably be found in the markets that the ultra-wealthy in the U.S. are competing for. Single-detached homes in the most luxurious neighbourhood around the New York area - The Hamptons. While the most recent reports from real estate activity in the area date to the end of October 2020, the price action in this area has been so dramatic that even the data for Q3 2020 paints a clear picture of what is happening.

Looking at several real estate reports, the average sale price for a home in The Hamptons has increased by 46% through Q3 2020 - data for Dec 31st, may make these numbers even higher. According to Saunders Realty, the dollar volume of sales for all of The Hamptons in the third quarter of 2020 was 103% higher than the same period in 2019, and the median price was 40% higher.

Summary:

We can see from the data above that the real inflation that wealth market participants are perceiving is far, far away from the 1.8% inflation reading that the CPI displays the general public. This is helpful in understanding why so many high net worth individuals are looking to protect their wealth and finding refuge in Bitcoin. With a $1.5 T spending program potentially around the corner, this trend does not show any signs of slowing down.

Difficulty Commentary

Not much has changed on this front since last week - we are still at our all-time high for difficulty of 20.61 TH and our next difficulty adjustment is projecting an increase to 21.9 TH or 6.27%. The next adjustment is projected to come in on Friday evening or early on Saturday morning. Despite the added hashrate operating at the moment, the mempool is quite built up at the moment so transaction speeds may be slower and more expensive than usual to process.

What's ahead for the week:

Two very relevant events in the U.S. this week.: We get long-awaited Joe Biden presidential inauguration on Wednesday and U.S. Corporate earnings start in earnest this week. On tap we have Bank of America, Goldman Sachs, Netflix, Silvergate & others on Tuesday, Morgan Stanley & others on Wednesday, Intel & many more on Thursday and Friday. As we mentioned above, Price to Earnings ratios have been expanding for the S&P 500 index, so this round of earnings will provide an opportunity to see if corporate earnings can start catching up to valuations. Some analysts are predicting that the market is underpricing a potential upbeat outlook from several sectors in this round of earnings - something to keep in mind as we enter earnings season.

As far as Bitcoin goes, the price action that we are seeing is consistent with speculative action around the "crypto market" in general. The DeFi index grossly outperformed not only Ethereum and Bitcoin last week, but also gold and U.S. equities. These signs, as we've discussed here in the past, are typically what you see in an overheated market. On the options side, there is a large open interest position in the $52k strike for Jan 29th on Deribit. We've discussed here in the past that these large moves sometimes tend to create buzz and a certain "gravity" around them.

We also saw that Greyscale Bitcoin Trust opened up again for purchases/contributions last week and within 24 hours it saw an increase of 5,132 BTC, or around $189 M. Earlier this week Greyscale announced that it closed the year at $20.2 B under management, up from $2 B at the beginning of the year. It went on to say that the growth has been "driven by demand from institutional investors such as hedge funds, endowments and pension funds". The reopening of the contributions could potentially act as a catalyst in the coming week, however, - investors should operate with caution as the signs of volatility are all around us.

As always, we'll keep you posted on any relevant news throughout the new year right here and from our Twitter account @hodlwithLedn

Corporate Earnings

Tuesday: Bank of America, Goldman Sacha, Silvergate Bank, Netflix.

Wednesday: Morgan Stanley

Canadian Central Banking Updates:

Current Target Interest Rate: 0.00 - 0.25%

Current Overnight Money Market Rate: 0.23%

Source: https://www.bankofcanada.ca/rates/

U.S. Central Banking Updates:

Current Fed Interest Target Rate: 0.00 - 0.25%

Current Effective Federal Funds Rate: 0.09%

Source: https://apps.newyorkfed.org/markets/autorates/fed%20funds