💥 Meet Ledn's New Savings experience

At Ledn, we know that the collapse of several CeFi lending platforms has impacted your trust in the industry and that the bankruptcy proceedings were costly and time-consuming for many.

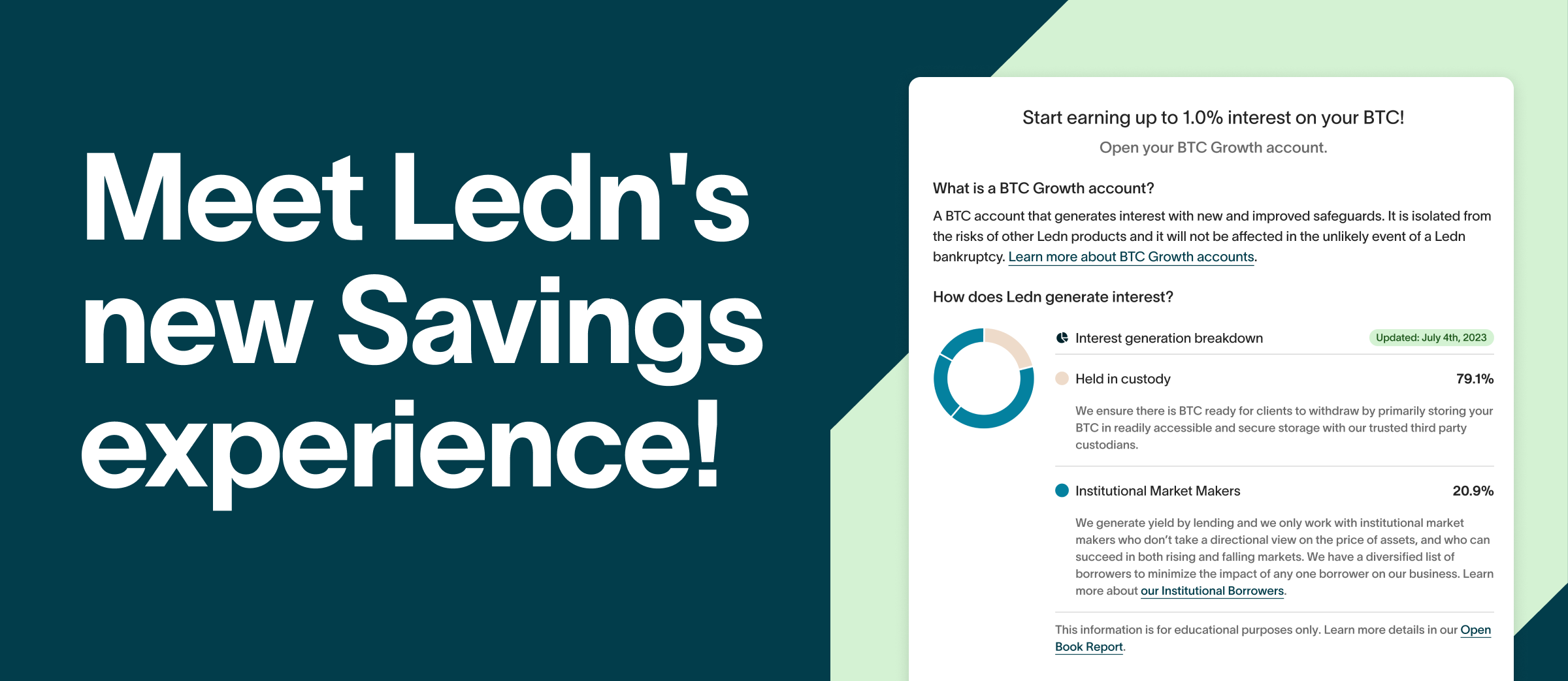

As a result, we’ve rebuilt our savings experience by introducing new and improved Ledn Growth Accounts.

What’s different vs. my current savings experience?

Control:

You will have two accounts for both BTC and USDC, giving you complete control over your assets:

-

- An interest earning Growth Account

- A non-interest earning Transaction Account.

Safety:

Ledn's Growth Accounts are ring-fenced, meaning that you are only exposed to the counterparties that we lend your assets to in order to generate your yield. If there are losses associated with any other yield generation activity that Ledn engages in for our other products, or in the unlikely event that Ledn goes bankrupt, your assets are not impacted!

Transparency:

A new client dashboard enhances visibility into how your interest is generated, complementing Ledn’s Open Book Report.

Access:

As with all yield generating products, there are risks associated with Growth Accounts. It is possible that institutional loan losses may happen which could affect your Growth Account. However, in the event of a non-performing loan with one of the institutional counterparties that generates your yield, you will still be able to quickly access unimpaired funds.

How do I use my new Transaction and Growth accounts?

You can think of your Transaction account as the engine of your Ledn account. It’s how you can deposit and withdraw your assets to and from Ledn and decide how you want to use your assets, whether that’s earning interest in a Growth account, taking and managing a loan or opening a DCN. All activity for your Ledn account goes through this account.

Your Growth account has a single purpose, which is to earn interest with the new safeguards that have been introduced. You can add and remove funds via your Transaction account.

Related Content: Watch Growth Accounts explainer video

When will the Transaction and Growth Accounts be available?

-

BTC: Effective August 3, 2023 (the Transition Date), your BTC Savings Account will be transitioned into the new dual account structure: (1) a non-interest earning BTC Transaction Account; and (2) an interest earning BTC Growth Account. On the Transition Date, the account balance in your BTC Savings Account will be automatically moved into your BTC Growth Account, unless you have auto top-up enabled for any of your Ledn loans. If you have auto top-up enabled for one or more of your Ledn loans, the account balance in your BTC Savings Account will be automatically moved into your BTC Transaction Account.

-

USDC: There will be no change to your USDC Savings Account on the Transition Date noted above. The account balance in your USDC Savings Account will remain in such account and continue to be interest earning. It is expected that your USDC Savings Account will be transitioned into a dual account structure in September 2023.

Should you have any questions, please contact support@ledn.io.

Thanks,

The Ledn Team