Ledn's Open Book Report: June 2023

Ledn is committed to leading and reshaping the digital asset lending industry with transparency and accountability. As part of this commitment, we released our first-ever monthly "Open Book" Report last month. In it, we provide details on the current utilization of USDC and BTC assets so that clients can understand how we generate interest for our Savings accounts and offer lower loan interest rates. Below, you will find our report for June 2023.

At Ledn, we strive to be the most trusted and transparent digital asset lender in the world. Our regular POR, Ledn Check-Ins, and this monthly report are all part of that commitment. We welcome your feedback at support@ledn.io.

Thank you,

Ledn Management

USDC

Retail Loan Book (81.9%%)

The primary way we generate yield for our USDC Savings accounts is by lending to our retail loan clients. These loans are secured by issuing loans with a minimum digital asset-to-borrowed funds ratio of 2:1, with the interest rates from our loans determining the yield we pay for balances in our USDC Savings accounts. We have strict safeguards in place, including automated margin calls and liquidation protocols, to ensure that the loan principal is protected, thereby enhancing the safety of USDC assets. This over-collateralized retail loan book has never experienced a loss across $550M+ of loans originated since Ledn’s inception.

High Quality Institutions (7.3%)

We use institutional partners to keep our retail loan book and USDC assets balanced. If our retail loan book demand exceeds our USDC supply, we work with select institutional partners to borrow USD/C by posting BTC with them as collateral. In the event that our USDC supply exceeds the demand from our retail loan book, we will lend USD/C to our institutional partners to generate yield.

We work with institutional market makers, who pay Ledn in return for borrowing USDC. These institutions use USDC to post as collateral on the exchanges where they provide market-making services, as well as to settle trades where USD forms one leg of the trade. They do not take a directional view of the markets, and are all vetted and monitored by Ledn’s risk management team. We work with a diversified list of borrowers in order to mitigate the impact of any one borrower on our business.

Custody & Banks (10.8%)

We hold USD/C in custody and with our banking partners for operational purposes, including to ensure that we can always process your withdrawals smoothly. Ledn has never had to pause client withdrawals. In some cases, we may put these funds in highly-liquid, low-risk investments such as money market instruments and treasuries.

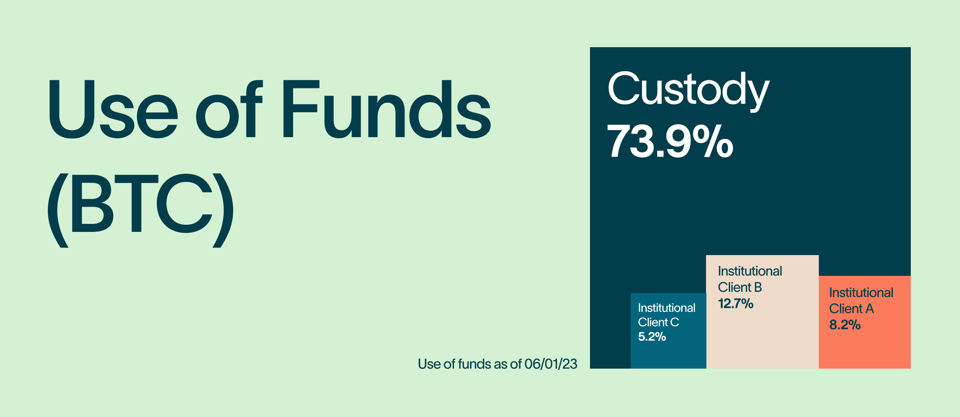

BTC

Custody (73.9%)

We hold BTC in custody for operational purposes, including to ensure that we can always process your withdrawals smoothly. This BTC is readily accessible and maintained at levels that are monitored daily by the Ledn operations team. Ledn has never had to pause client withdrawals.

High Quality Institutions (26.1%)

We work with institutional market makers, who pay Ledn in return for borrowing BTC. These institutions use BTC to post as collateral on the exchanges where they provide market-making services, as well as to settle trades where BTC forms one leg of the trade. They do not take a directional view of the markets and are all vetted and constantly monitored by Ledn’s risk management team. We work with a diversified list of borrowers in order to mitigate the impact of any one borrower on our business.

Collateralized Lending

Right now our collateral ratio on our USD/C loan book is 225.6%. However, this value includes all loans outstanding (including collateralized, under-collateralized and uncollateralized). It is important to separate out this detail:

| Collateralized Loans as % of Total USD/C Loan Book | 91.9% |

| Uncollateralized Loans as % of Total USD/C Loan Book | 8.1% |

| Collateral Ratio of Collateralized Loans | 245.2% |

Ledn's Risk Management Policies

Ledn’s stringent risk management practices play a critical role in safeguarding our clients' digital assets, including BTC and USDC collateral. We take pride in how our credit underwriting and risk management policies have performed through various periods of market stress.

Ledn’s credit risk management policy relating to institutional borrowers is based on three key tenets:

- Generating yield by lending to the lowest risk sector in the digital asset borrowing universe

- Working with creditworthy institutions

- Lending principles

Ledn generates yield by lending only to institutional market makers

- We are very selective in our choice of institutional borrowers. We have increased our focus on those who make the vast majority of their revenues in traditional finance market-making which are now applying their many years of experience to the digital asset world.

- We generate yield through lending, and we only work with institutional market makers who don’t take a directional view on asset prices, and who can succeed in both rising and falling markets. These market makers also tend to do well during times of volatility. All this allows us to pay a steady stream of interest to you through volatile market conditions.

- Within the market-making sector, we work with a diversified list of borrowers to minimize the impact of any one borrower on our business.

Ledn only works with creditworthy institutions

- We implement strict credit underwriting requirements that we bring from over 25 years in traditional finance.

- As part of these requirements, we need (i) complete transparency on the financial position of the borrower which is required to be updated on a regular basis, (ii) a complete understanding of the strategies used by our borrowers to generate revenue, (iii) strong relationships and connectivity with senior management at the borrower with rapid response time on any queries we may have, and (iv) visibility into where the assets we lend to them are being deployed.

- We have near-daily contact with all of our borrowers at the highest levels within their institutions.

Sound Lending Principles

- We carefully select the assets that we support. Ledn currently supports only Bitcoin & USDC, two of the highest quality and most liquid assets in the industry.

- Ledn has deliberately chosen not to engage in DeFi yield farming strategies with your assets to generate yield.

- As part of our risk management practices, we have firm policies in place that govern the tenor matching of our assets and liabilities.

- For some institutional market-makers, we will only lend to them on a collateralized basis (collateralized with USDC, BTC, or ETH) in order to manage credit risk, based on factors including, but not limited to: (i) the overall size of their balance sheet, (ii) track record of relatively new players in the digital asset space, and (iii) new relationships with founders and senior management.

- We may lend to some institutional market-makers on an uncollateralized basis if we determine them to have a sufficiently strong track record and creditworthiness.

- We maintain our strict credit underwriting requirements for each borrower independent of collateralization requirements. This combined approach reduces the probability of loan losses in times of market stress.

Disclaimer: This report (including any data contained herein) is provided for clients of Ledn Inc. (together with its affiliates and subsidiaries, “Ledn”) on an ‘as is’ and ‘as available’ basis at the sole discretion of Ledn and solely for informational and educational purposes. Ledn expressly disclaims all liability and all warranties of accuracy, completeness, merchantability or fitness for a particular purpose with respect to this report. Past performance is no guarantee of future results. You are strongly cautioned that reliance on any forward-looking statements involves known and unknown risks and uncertainties. Please read our full disclaimers at https://www.ledn.io/legal/disclaimers.