Since Russia invaded Ukraine on February 24, 2022, the international sanctions have not ceased on the Kremlin. The international sphere has seized assets, stopped trading of Russian-native stocks, booted Russian financial institutions from using SWIFT and imposed embargoes on oil, gas and other natural resources. With the ruble and economy tanking, Russia must look for ways to have access to capital. The Russian head of the country’s energy committee - Pavel Zavalny, announced that it may accept Bitcoin as a form of payment.

Despite all the sanctions, Europe’s dependence on Russian oil and gas is still present. Since the invasion on February 24, Europe has paid over $22 billion to Russia for fossil fuels. Something that is surprising is that Russia's oil business has shown resilience despite market cycles. Even after the invasion, Russia continues to export 4.7 million barrels of crude a day. Russia is in need of cash to fund military equipment, thus has continued to produce and export oil to prewar levels.

As some countries are forced to reconsider their financial rails and their foreign reserves, a few references have been made about “Bancor”.

From Wikipedia:

“The bancor was a supranational currency that John Maynard Keynes and E. F. Schumacher[1] conceptualised in the years 1940–1942 and which the United Kingdom proposed to introduce after World War II. The name was inspired by the French banque or ('bank gold').”

In simplified terms, the concept was to create a “supranational currency” that allowed exporting countries to accumulate as reserves, and importer countries to borrow bancor from creditor countries. Both would have limits on what they could store away and borrow. If either limits were reached, the country’s currency would either appreciate (in the case of too many reserves), or depreciate (in the case of too much debt). This would make their exports more or less expensive, and balance the overall trade.

This option was - of course, dismissed by the U.S. after WWII, who instead decided to set the U.S. dollar as the world reserve currency, initially pegging the U.S. dollar to gold and peging every other currency else against the U.S. dollar.

Interestingly, there was positive commentary after the recent peace talks held in Turkey. This has helped push oil prices lower in the week’s trading session so far.

Moving on to other news - contrary to the headline below, there are no rumors….

That is the beauty of blockchain, it provides transparency and real-time verification. The Luna Foundation Guard “LFG” has been purchasing Bitcoin and accumulated $1.3 billion worth of Bitcoin. The wallet address statement can be seen and lists all the Bitcoin transactions.

Additional factors that could be contributing to the Bitcoin price momentum was Goldman Sachs and Galaxy Digital’s milestone over-the-counter “OTC” trade as well as Cowen’s plan to allow institutional investors to place Bitcoin spot trades. Cohen is a publicly traded U.S. investment bank with a market capitalization of over $700 million.

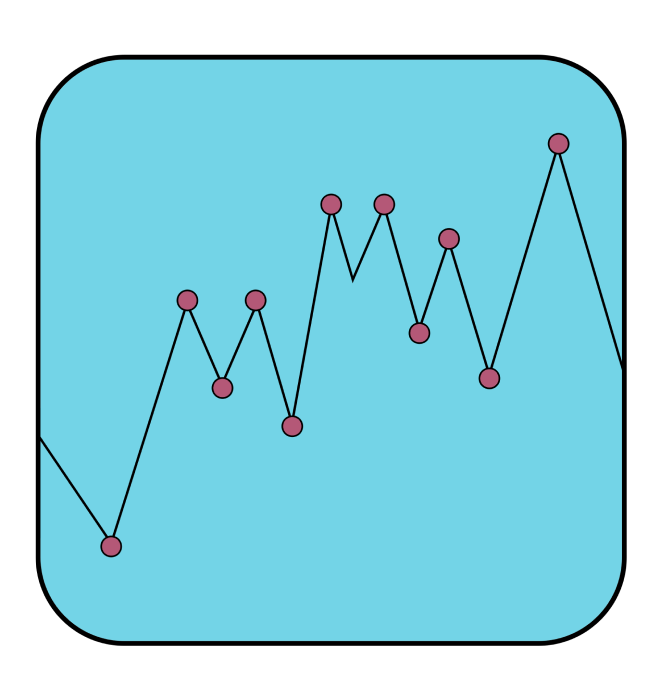

Earlier in the year, the Bitcoin spot market was trading higher than the Bitcoin futures market, or in technical terms, the curve had “backwardation”. Backwardation occurs when investors expect the future price of the asset to trade at lower prices than the current one - this can happen for a variety of reasons.

With the increase in price, futures once more have begun to trade higher than Bitcoin spot levels.

Bitcoin Futures Open Interest have trended upward after reaching 2022 lows. As Bitcoin price has rebounded and is now trading above its December 2021 levels, investors once again have regained appetite for Bitcoin futures. Binance and CME futures have seen the biggest interest on their platforms compared to its competitors.

Compared to last week, we have seen funding rates for Bitcoin perpetuals increase, as interest for Bitcoin has increased. Positive funding rates suggest that investors are bullish. It also implies that long traders pay funding to short traders.

Also, hot off the press this morning, Grayscale, the operator of the Grayscale Bitcoin Trust, threatened to sue the SEC if it rejects its upcoming spot bitcoin ETF proposal. This ups the ante for the SEC’s decision, and could result in GBTC units reducing some of their discount to the fund’s net asset value. The fund’s units currently trade at about a 28% discount to the value of the assets it holds.