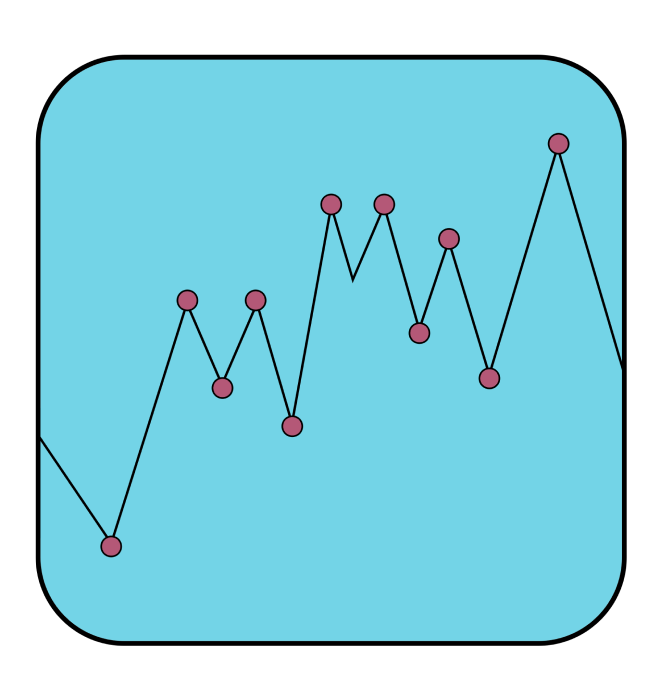

The value of most global currencies vs. the U.S. dollar is plummeting.

In India, the U.S. dollar has reached a record high vs the local Rupee.

In Japan, the Yen has reached its lowest level in 20 years:

The U.S. dollar also reached parity with the Euro for the first time in 20 years this morning:

A lot of Latin American currencies are also melting:

Now, I can only speak to my experience in Latin America, but life has taught me that the inflationary playbook is very similar among central bankers and politicians.

Inevitably, it starts as a normal bout of inflation. However, local politicians will quickly start losing their grips as inflation turns into protests - (see Sri Lanka).

In an attempt to prevent runaway inflation, most central banks will try to enact emergency interest rate hikes, but these are most often futile in taming inflation or unrest - especially if this inflation is driven largely by sources outside of your control (i.e. a war in Russia).

What will likely then happen is that politicians will start asking people not to “speculate” against their own currencies.

These requests will also land on deaf ears because it’s effectively telling Colombians (or anyone else) that they can’t protect their savings.

And so, governments may resort to capital controls - a flat out prohibition of exchanging your local currency into anything else (through the local banking system). Which pushes everyone to the P2P markets, and has the worst impact on the most vulnerable members of society.

However, it is in these circumstances of deep despair and unfairness, that many people - like myself, found bitcoin. Bitcoin and stablecoins can provide a lifeline to people all over the world.

World economies seem to be heading towards a hostile environment. Far from being a headwind, this is bitcoin’s time to shine.

To wrap it up, this week we get a potentially record-setting inflation reading, the start of Q2 earnings season, and several Fed speeches:

Tuesday

Earnings: PepsiCo

6:00 a.m. NFIB survey

12:30 p.m. Richmond Fed President Thomas Barkin

1:00 p.m. $33 billion 10-year Treasury note auction

Wednesday

Earnings: Delta Air Lines

8:30 a.m. June Consumer Price Index

1:00 p.m. $19 billion 30-year bond auction

2:00 p.m. Federal budget

2:00 p.m. Beige book

Thursday

Earnings: JPMorgan Chase, First Republic Bank, Conagra, Morgan Stanley, American Outdoor Brands, Cintas, Taiwan Semiconductor

8:30 a.m. June Producer Price Index

11:00 a.m. Fed Member Speech: Fed Governor Christopher Waller

Friday

Earnings: Wells Fargo, Citigroup, PNC Financial, Bank of New York Mellon, U.S. Bancorp, State Street, UnitedHealth

8:45 a.m. Fed Member Speech - Atlanta Fed President Raphael Bostic

It's a big week coming up, and as always, we'll keep you posted on any relevant news throughout the week right here and from our Twitter account.

This article is intended for general information and discussion purposes only, it is not an offer, inducement or solicitation of any kind, and is not to be relied upon as constituting legal, financial, investment, tax or other professional advice. This article is not directed to, and the information contained herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to law or regulation or prohibited by any reason whatsoever or that would subject Ledn and/or its affiliates to any registration or licensing requirement. This article is expressly not for distribution or dissemination in, and no services are being marketed or offered to residents of, the European Union, the United Kingdom or the United States of America. A professional advisor should be consulted regarding your specific situation. Digital assets are highly volatile and risky, are not legal tender, and are not backed by the government. The information contained in this publication has been obtained from sources that we believe to be reliable, however we do not represent or warrant that such information is accurate or complete. Past performance and forecasts are not a reliable indicator of future performance. Any opinions or estimates expressed herein are subject to change without notice. We expressly disclaim all liability and all warranties of accuracy, completeness, merchantability or fitness for a particular purpose with respect to this article/communication. For full legal terms and conditions visit https://ledn.io/legal

%20-%20BEC_CTA_B2X.jpg)