The week ahead will deliver Coinbase’s Q2 earnings report and July’s inflation reading in the U.S. In today’s piece we examine how both events could impact price.

Last week Coinbase announced a landmark partnership with Blackrock, one of the world’s largest asset managers. In light of the company’s recent announcement, and the stock’s relative performance compared to the Nasdaq, its stock price could rally further if it posts strong results and positive guidance.

If this positive scenario plays out, it could act as a broader tailwind for digital asset prices, including bitcoin.

Even if the company’s performance for Q2 misses the mark, investors could see it as a buying opportunity, preventing the stock price from dropping by a large margin.

For context, Blackrock manages over $10 Trillion in assets. That’s close to the entire market capitalization of gold and more than 20 times the market capitalization of bitcoin.

Disclosure: Coinbase is an investor in Ledn.

Elsewhere in the space, anticipation continues to build around the upcoming Ethereum merge. Last week we reported how open interest in Ethereum options had surpassed open interest for bitcoin options for the first time in history.

This week, we will examine Ethereum futures and potential implications to Ethereum derivatives emanating from The Merge.

As we’ve covered in previous issues, the Futures market and the derivatives markets are instruments that allow investors to access significant leverage.

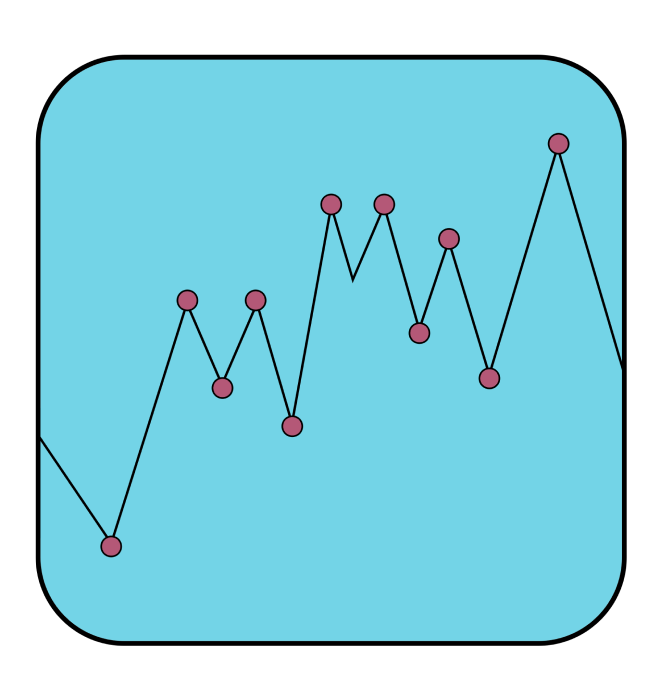

Not surprisingly, we are seeing an increase in the futures interest around Ethereum contracts. By dividing the spot volumes by the aggregate futures volumes, we can get a proxy for leverage activity in each asset. Below are the spot-to-futures comparisons for both Bitcoin and Ethereum.

As you can see from the graph, the spot-to-futures ratio on Bitcoin is currently north of 0.2 and rising - whereas the same ratio for Ethereum is at 0.14 and dropping. The lower the ratio, the higher the leverage - therefore we can infer that there has been more relative leveraged activity on Ethereum futures than on Bitcoin futures recently. This is consistent with rising speculative activity around the merge.

The Merge will also have implications for the shape of the Ethereum futures curve.

As Mike McGlone from Bloomberg intelligence pointed out recently, the 1-year implied yield on gold is almost identical to the 1-year U.S. treasury bond yield. Meaning that, since gold cannot generate interest natively, and has relatively low storage costs, the cost to carry and deliver a contract in the future is the current price of the asset plus the time to maturity multiplied by the risk-free interest rate.

While the risk-free rate is low, it still means that the price for gold or bitcoin in the future should be higher than the spot price - making the futures curves slope upward and to the right.

Ethereum will be different because it can be staked to generate interest. Therefore, the price of Ethereum for future delivery will have a different calculation. The cost to carry and deliver Ethereum into the future will have to be calculated as the current spot price, plus the time to maturity multiplied by the difference between the staking yield minus the risk-free rate. This means that if the staking yield is higher than the risk free rate (very likely the case), then the price for future Ethereum contracts will be lower than the spot price. This means that the Ethereum futures curve will look very different, as it will slope downwards and to the right - getting more negative as it is farther into the future.

Checking in on Argentina and Nigeria:

The Argentinian and Nigerian economies continue their descent down the inflationary spiral.

Headlines last week were once again, par for the course.

Bloomberg reported that Argentina is running out of reserves to stave off a material devaluation in their “official” exchange rate.

Adding to the challenge is the fact that many central banks are not transparent about their reserves - especially in Latin America.

The latest estimates from economists suggest that Argentina has about $38 Billion left in their reserves, with very little of it being in the form of liquid assets that could be used to defend the exchange rate.

Further evidence of the collapse is the fact that Argentina’s “official” inflation data, surpassed that of Venezuela for the month of July.

There has been no mainstream news regarding bitcoin or stablecoin volumes locally in Argentina this week. We’ll continue to monitor and share.

Nigeria

The updates from Nigeria show a similar picture.

As reported by a local newspaper, Nigerians are starting to replace items in their shopping list with lower-cost alternatives. Generally, people resort to substitution before having to cut back on consumption - but that is the natural next step.

Another article by Cointelegraph last week reported that “nearly 17.36 million, or 52% of Nigerian crypto investors, have allocated over half of their assets to cryptocurrencies. Nigerians started using crypto as a viable alternative to store and transfer assets.”

This week we also get an inflation reading from the U.S. which could impact bitcoin markets. Details in our What’s Ahead section.

%20-%20BEC_CTA_B2X.jpg)