CeFi vs DeFi - Key Differences Explained

.png?width=1600&height=900&name=CeFi%20vs%20DeFi%20%20Key%20Differences%20Explained%20(1).png)

There are two key terms that underpin the entire crypto industry: centralized finance (CeFi) and decentralized finance (DeFi). Practically every company and project in this space falls under one of these concepts, or utilizes a mix of the two. However, at first glance, it can be hard to figure out what exactly makes them different from each other, and what their benefits and downsides are.

When it comes to crypto lending and saving, it is crucial to understand how both CeFi and DeFi work, as this will determine which type of service you want to work with. They both have some subtle and striking differences that are relevant to every type of crypto enthusiast. Let’s delve into these differences, and explain what makes them stand out against one another.

What is CeFi and How Does it Work?

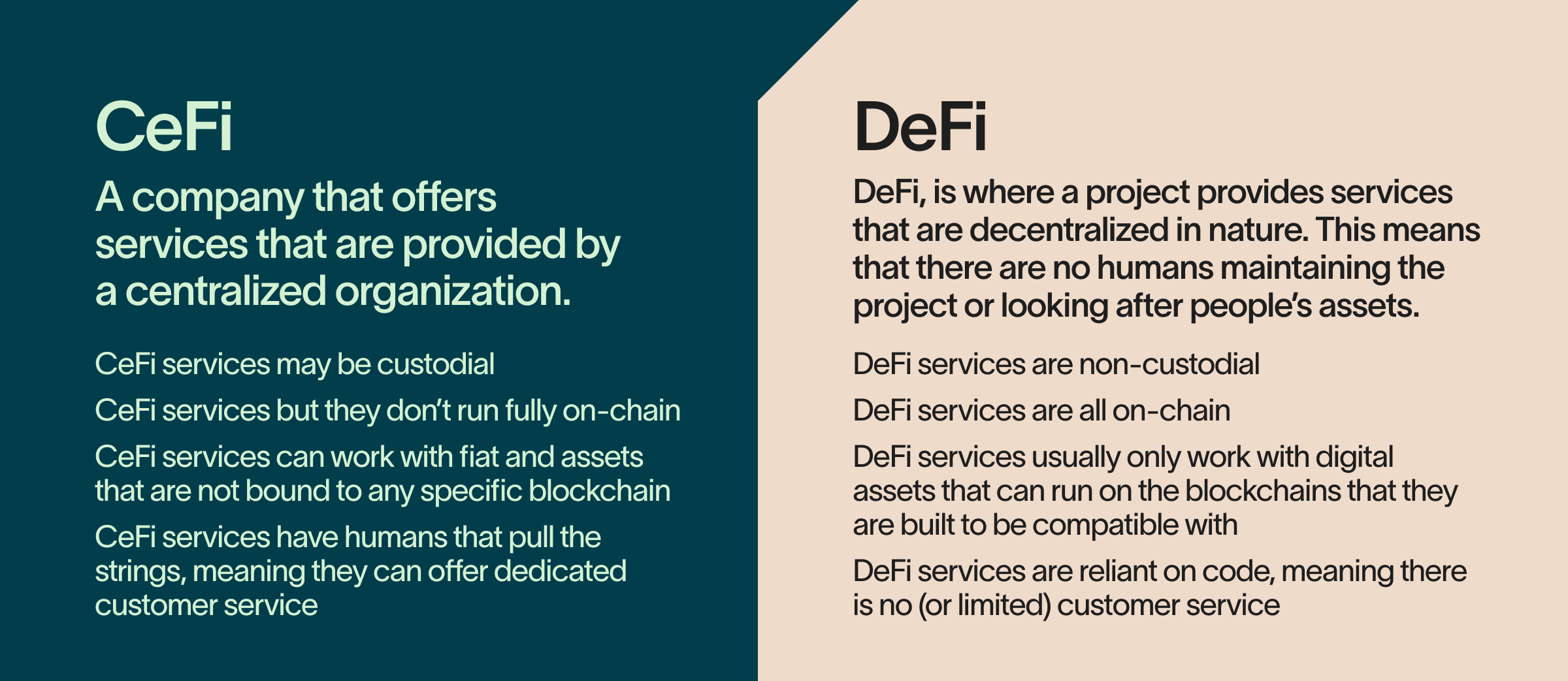

Centralized finance, or CeFi, is where a company offers services that are provided by a centralized organization. This means that there are humans who control the service and keep it running. All traditional finance is centralized, including banks and stock exchanges. However, many cryptocurrency exchanges and lending providers, such as Ledn, are also CeFi. With a CeFi company, you place your trust in a team of individuals who manage your digital assets and take care of them.

What is DeFi and How Does it Work?

Decentralized finance, or DeFi, is where a project provides services that are decentralized in nature. This means that there are no humans maintaining the project or looking after people’s digital assets, but rather a network of code and programs that keep the system running. These are upheld by a collection of people from around the globe who vote on matters related to the network, where no one individual has control or guardianship of somebody else’s digital assets. There are many decentralized exchanges and lending providers that run like this. An example of this is Curve, a lending protocol that is meant to run without any central control.

Key Differences Between CeFi and DeFi

The major difference between CeFi and DeFi is with regard to how control is distributed. CeFi services have a team of people who control the whole company, as well as manage people’s funds. DeFi services are meant to be autonomous, meaning they run on their own, with no individuals who have control, and where blockchain networks and smart contracts keep things running. In a CeFi service, you hand your digital assets over to another party to handle. In a DeFi service, you maintain control, with your assets being at the mercy of the network and its underlying code and architecture.

Let’s break this down:

- CeFi services may be custodial, whereas DeFi services are not.

- CeFi services may use blockchain technology, but they do not run fully on-chain, whereas DeFi services are all on-chain.

- CeFi services can work with fiat and assets that are not bound to any specific blockchain, whereas DeFi services usually only work with digital assets that can run on the blockchains that they are built to be compatible with.

- CeFi services have humans that pull the strings, meaning they can offer dedicated customer service, whereas DeFi services are reliant on code, meaning there is no (or limited) customer service.

Advantages of Centralized Finance (CeFi)

Let’s take a look at what the major benefits are of using a CeFi service, such as Ledn.

Reliability

When you work with a CeFi company, you are engaging with a fully-fledged and knowledgeable collective of people who knows and understands their craft to an extremely high degree. DeFi projects often present themselves as being more reliable because you only need to care about the programming and code that underpins them, but in truth, decentralized technologies are an experimental practice, where the best methods are still being developed. This means that DeFi systems can break down or get hacked in unpredictable ways, due to their novelty and youth.

When it comes to CeFi, on the other hand, you work with individuals who have direct experience with handling other people’s assets and treating them with the care and attention they deserve. With the right team, any issue can be mitigated, so long as there are reliable and robust protocols and risk management procedures.

Regulations and Compliance

CeFi companies typically need to follow legal regulations to operate. This is a good sign as it means that they are answerable to the courts and regulators of the countries they work within. This means they must act with more caution than a DeFi service, as these usually operate outside of many legal frameworks.

Ease of Use

There is often a lower learning curve for using a CeFi service, as they come with a team of humans who can help you along the way if you get confused. They are able to take charge if any issues arise. Plus, a CeFi crypto lending and saving service will typically be set up in a way that is similar to more traditional companies that deal exclusively with off-chain operations, such as those working with fiat or with stocks. This means that, if you have experience working with these types of companies already, then the process will be relatively similar for CeFi crypto tools.

Customer Service

CeFi services are able to offer customer service, where they can help you out with any issues that might arise. This is closely connected to the previous point, as having a team on-hand who you can call upon makes for a more pleasant and smooth experience. With DeFi, customer service tends to be highly limited or even non-existent, as the processes that happen are usually automated from start to finish.

Liquidity

Generally, CeFi services have access to deeper and more stable liquidity due to their connections with traditional financial systems, professional market makers, and other liquidity sources. Therefore, they have more freedom when it comes to arranging for liquidity. DeFi services, on the other hand, often rely on liquidity pools, which are provided by their community and user base. The amount of liquidity they have on-hand will be dependent on what their community can provide, which can sometimes cause shortages and issues.

Security

CeFi services often employ a robust and multi-layered approach to security that encompasses both on-chain and off-chain measures. For on-chain activity, CeFi platforms can utilize various cryptographic and blockchain-based tools to ensure the integrity of transactions. They may also use additional security measures such as multi-signature wallets. For off-chain activity, they can use cold storage, robust firewalls and cybersecurity methods, and insurance policies (in case of tragedies). Essentially, they can provide a more holistic approach to security, rather than being limited to purely on-chain actions (such as how DeFi services work).

Greater range of assets

A CeFi platform can make use of many assets, including fiat and Bitcoin. DeFi services, on the other hand, can only work with cryptocurrencies that are compatible with their network. This means there is never fiat support, and rarely ever Bitcoin support either. Usually, they work with ETH and Ethereum-compatible tokens (although some projects use other crypto assets, as well).

Disadvantages of Centralized Finance (CeFi)

Of course, despite there being many positives to using CeFi, there are some negatives that you should know about.

Custody Risk

All CeFi services are managed in a centralized manner, meaning that you hand your assets over to a third party who you must place your trust in. If you are working with a company that has a good track record, strong risk management protocols, and can prove their legitimacy, then this becomes a non-issue. However, there have been several CeFi lending companies that have collapsed or become insolvent in the past, leaving end users who entrusted them with their digital assets in dire positions. BlockFi is perhaps one of the largest examples of this type of disaster happening.

Geographical Restrictions

As CeFi companies need to follow regulatory measures and be compliant with the laws of the countries they work with– this means that very few (if any) of them can offer their services to the entire world. To operate in any country, a CeFi company must ensure they are strictly keeping in line with the laws of the nations they function within.

DeFi services, on the other hand, do not need to do this. Their decentralized nature means that they are not limited by any nation-specific laws, as they are distributed globally and do not have one central point of control. However, this is only true if the project itself is fully decentralized, and not decentralized in name only.

Cyberattacks

No technological service is impervious to hacking. This is the case for both CeFi and DeFi. If a company uses computers in some way, then they are at risk of some level of hacking. CeFi companies are theoretically able to handle cyberattacks better, due to their wide-ranging and holistic security approach, but they can also fall victim to them.

High Fees and Low-Interest Rates

High-quality and sensible CeFi companies often have fees that are higher fees and interest rates than their DeFi counterparts. This is because they put more effort into their risk management, and have more overhead costs, due to being fully-fledged companies. DeFi projects have fewer costs to cover as they are largely automated, meaning they can provide more desirable rates. That being said, there may be times when it is preferable to go with a CeFi service even if it does not offer the best rates on the market, as you can know that the reason for this is so they can provide a more robust and reliable product.

Advantages of Decentralized Finance (DeFi)

We’ve covered CeFi’s pros and cons, so let’s now take a look at how DeFi compares.

Autonomy

DeFi services are not managed in a centralized manner. This means that you keep control of your money, rather than handing it over to somebody else. This is even the case with DeFi lending and saving. While it may seem like you hand your money over to another party when it comes to offering collateral for a loan or locking your assets away for a savings account, this is not typically the case. Rather, users who do this are actually placing their assets within a smart contract that is managed by both themselves and the coding of the contract and the network in question. Essentially, even when this happens, you are still the one who keeps control.

Related Content: Best Defi Loans Compared

Censorship Resistance

DeFi services are automated, meaning that there are no humans at the helm who have complete control. This makes them impervious to being shut down by governments or other parties. In the world of centralized finance, a government can close a company down and render it defunct, but with DeFi, this is not possible as its power is distributed globally.

Accessibility

DeFi services are available to everybody, with there being no restrictions on who can, or cannot, access them. They do not take any KYC or AML information from you, meaning you do not need to send over sensitive documentation such as passports or proof of residency. With the lack of humans operating, this means there is no way for them to verify or vet any user. They are essentially a network that is open to all.

Disadvantages of Decentralized Finance (DeFi)

High Volatility

DeFi services tend to work with more volatile assets. For instance, an Ethereum-based DeFi lending provider will often be compatible with every Ethereum-based asset on the market (so long as there is enough liquidity available)– this can create highly volatile situations, as smaller assets have a tendency to fluctuate significantly.

Hacks and Risks of Smart Contract Failures

Smart contracts are the backbone of any DeFi lending service. However, they are also arguably its weakest point when it comes to security. If a smart contract is faulty, or there is a way to exploit it, then it can cause major problems for the end user. This is because it can lead hackers to siphon digital assets away from the protocol and leave unsuspecting customers in a poor financial position. A recent case of this happening was with Curve Finance, a DeFi protocol that was targeted by hackers who exploited its Vyper programming language, used to write its smart contracts. In the process, over $70 million was stolen from the network.

Scalability Issues

A DeFi service is only as scalable as the blockchain it runs on. If that blockchain gets congested or inundated with transactions, then it can cause the network to get sluggish. Not only can this make for slow transactions, but it can even increase fees for users. For instance, if you use an Ethereum-based service, then periods of high activity can mean your gas fees can rise, just so that you can have your transactions added to the blockchain. This was a major issue during the 2020-2021 bull market, where on-chain transactions soared, leaving many users paying hefty fees.

Privacy Concerns

DeFi services have a strange relationship with privacy. On one hand, you could say that your actions are more anonymous in the sense that you do not need to hand over identifying documentation (or even provide a real name). On the other hand, everything that happens is on-chain, meaning there is a public ledger that documents your activity in explicit detail. However, despite the fact that you do not give over such sensitive documents, this does not mean it is impossible for somebody to track your actions.

With enough time and resources, somebody can figure out your crypto addresses and follow your transactions and activity. Most individuals do not need to worry about this, but some companies who are looking for a loan or savings account may be apprehensive, as their transactions could reveal sensitive business information or strategic insights to competitors or other interested parties. While the addresses used in DeFi transactions are pseudonymous and not directly tied to personal or company identities, patterns of activity can sometimes be analyzed to deduce who might be behind certain transactions.

Limited Customer Service

Due to their highly automated nature, DeFi projects have extremely reduced customer service measures. With these tools being autonomous and having no central point of control, this means that human intervention is often not possible. A consequence of this is that any people who face technical errors or issues will not be able to receive much care or attention as there is nobody controlling the system. There is very much a feeling of being alone when you use a DeFi service.

Can CeFi and DeFi Work Together?

People tend to view the crypto industry as an internal struggle between CeFi and DeFi services, with many arguing that one is wholeheartedly better than the other. But in reality, there is actually a lot of room for both to function together. There are some areas that CeFi excels at, and some where DeFi shines brightest; there is no reason why they cannot be used in tandem to create more robust and multi-faceted services.

For instance, CeFi can offer greater security due to its off-chain activity, as well as its ability to work with fiat and Bitcoin. And DeFi is great at creating networks that are globally distributed which gives users more control over their finances. Together, they could be used to build systems and products that offer the best of both worlds!

There is not an industry-accepted term for this, but some people label it as CeDeFi. It is where a hybrid approach that combines elements of both Centralized Finance and Decentralized Finance. There could be benefits ranging from greater security (with more robust on-chain security along with off-chain methods), better liquidity being gathered from more sources, and perhaps more innovation (as the marriage of these methods could create new opportunities for end users).

An approach promoting the merging of CeFi and DeFi may be the direction that the crypto industry heads towards. Back when the crypto space was born, it was built as a type of antithesis of centralization, offering self-custody and non-traditional financial instruments that were designed to be impervious to the problems that current-day institutions had succumbed to during the 2008/2009 recession. However, over time, we have seen that purely decentralized projects are somewhat limited and still vulnerable to certain attacks. Perhaps the future is a synthesis of these concepts, where they both help each other to avoid pitfalls, and can provide users with greater care and treatment.

What to choose for Crypto Lending - CeFi or DeFi?

While the future might be made up of CeDeFi projects, this current day and age is made up of projects that either fall into one or the other category. Therefore, it is worth asking which type of service somebody should embrace. They both have some major benefits and drawbacks, and both operate in different ways, so the sensible answer would be to take a look at what you want out of a financial service and see which protocols suit you best. Some people may prefer the self-custodial and on-chain nature of DeFi, whereas others may find the increased security and compliance of CeFi to be more desirable.

That being said, there is one special benefit that CeFi has, which DeFi is unlikely to match. If the future is one where the two concepts are used together, then it may be smarter to work with a CeFi company, as they can always employ DeFi protocols and bring them into their system at a later stage. Starting from a point of centralization means that they have the freedom to distribute their power away one day.

DeFi services, however, would struggle to do the opposite, as it would require the network voting to choose a centralized point of control, which is bound to cause in-fighting and disagreements. Therefore, if you are looking for a more future-proof crypto lending service, CeFi may be the way to go!

Conclusion

CeFi and DeFi are two of the most important concepts in this space. Learning about how they differ, and which areas they flourish in, is paramount to making the right financial decisions. A day may come when the distinction between the two fades, but until then, it is necessary to identify what makes them significant, and then assess which looks the most desirable to you.

To get an overview of both, in relation to lending, take a look at how Ledn stacks up against other projects via our evaluation of platforms and networks on the market right now. This will help you to get a feel for what different CeFi and DeFi projects offer.

Sponsored by 21 Technologies Inc. and its affiliates (“Ledn”). All reviews and opinions expressed are based on my personal views.