What is Crypto Lending & How Does it Work?

Crypto lending enables you to benefit from your crypto holdings without selling them. It is typically divided into two streams:

1) Lending crypto to earn passive income

2) Using crypto as loan collateral

Crypto lending offers a number of advantages, including speed, accessibility, competitive interest rates, and the ability to raise funds without selling your holdings. Anyone can lend crypto. You just need to own some cryptocurrency, and be able to access the internet.

If you’re new to the subject, it might seem complicated. In fact, it’s not. In this guide, we'll provide you with essential information, tips, and strategies to start lending your crypto.

What Is Crypto Lending?

Crypto lending is a way to earn interest in-kind from cryptocurrencies without dealing with market volatility. It enables you to earn passive income by lending your crypto assets, usually via a platform’s "savings" or "growth" accounts. Instead of leaving your crypto assets in your wallet, you lend them to borrowers who are willing to pay interest in exchange for using those assets.

Related Content: Stablecoin Lending: The Ultimate Guide

What are Crypto-Backed Loans?

Just as homeowners can use their house as collateral for a mortgage loan, crypto holders can pledge their coins as collateral to obtain a secured loan, in the form of cash or stablecoins. They can do anything they want with these funds.

Borrowers typically pay the loan back in instalments. At the end of the loan term, they get their crypto back. In the event of non-payment, crypto lenders can liquidate the collateral to recover their funds.

The size of the loan is a loan-to-value, or LTV, percentage of the cryptocurrency pledged as collateral. The percentage will be determined by the platform, but tends to be between 50% and 90%. Loan terms can be as short as seven days, or longer than a year.

Related Content:

There are two main types of crypto loans: CeFi and DeFi.

CeFi, short for Centralized Finance, allows the lender to control the crypto asset collateral during the loan repayment period and has the authority to manage it. Most crypto loans come from centralized platforms and fall into the CeFi category.

DeFi, which stands for Decentralized Finance, allows borrowers to lock their crypto assets collateral in a smart contract through a blockchain-based lending protocol. The smart contract can take action against the borrower if they default or miss a payment. DeFi loans often come with higher interest rates than CeFi loans.

Related Content: CeFi vs DeFi - Key Differences Explained

How Does Crypto Lending Work?

Crypto lending involves a crypto holder lending their assets to someone else for a fee. It works like this:

- The lender deposits their cryptocurrency on a lending platform.

- The platform (either CeFi or DeFi) pools these funds together, creating a “liquidity pool.”

- Borrowers can access this liquidity pool to borrow funds, following the conditions specified by platform.

- There are various conditions for the loan that may vary by platform, including the principal amount, annual percentage rate (APR), accepted collateral types, and the threshold at which the loan can be liquidated.

- Borrowers provide collateral to secure the loan. The platform enforces the agreed-upon terms. For CeFi lenders this is a human-led process, whereas for DeFi lenders, this is usually executed by smart contracts.

- Interest is typically charged on the loan, which benefits the lenders who deposited their funds into the liquidity pool.

How to Lend Your Cryptocurrency

There’s a crypto lending option for every level of risk tolerance.

First, choose a crypto lending platform that matches your goals and appetite for risk. Today, there are a number of platforms that offer the security and customer services of conventional banks.

You’ll then need to create an account and undergo the platform’s verification processes.

Once your account is set up, deposit the cryptocurrency you want to lend into the lending platform's wallet. Specify the amount you wish to lend and the lending period. The platform will match your funds with borrowers seeking loans.

Once your cryptocurrency has been lent out, you'll start earning interest. At the end of the lending term, you can choose to reinvest your earnings, withdraw your funds, or continue lending.

Is Crypto Lending Safe?

The sudden closure of leading CeFi lending platforms such as Genesis, BlockFi, Voyager, and Celsius, as well as the exchange FTX, last year was a reminder that crypto lending, like any investment activity, carries inherent risks. DeFi platforms are also susceptible to hackers as evidenced by recent events.

As a result, doing your due diligence on the different platforms is crucial. There are reputable platforms out there.. They generally use security measures such as encryption, multi-factor authentication, and custody solutions. There are no government backed protections for depositors if a crypto service provider goes bust, but platforms can take out insurance against theft or phishing attacks.

The volatility of cryptocurrencies introduces price risks that can impact the value of your lent out assets.

Related content: The Risks of Crypto Lending

Crypto Lending Rates (Yield vs. Borrowing)

Platforms set interest rates for lending and borrowing. These rates are determined by various factors, including the risk profile of the borrowers and the market demand for the currency. However, most crypto lending platforms offer higher annual percentage yields (APY) than most high-interest savings accounts.

Related Content: Best Crypto Interest Rates in 2024

While some platforms offer APYs as high as 25%, those are usually on highly speculative tokens. They don't have the transparency of more established platforms. Ledn, for example, offers APY of 9% on USDC (a stablecoin pegged 1:1 to the USD) or 1% on BTC.

Conversely, for those looking to borrow against their crypto, interest rates or borrowing rates (APRs) range from 5-16% depending on loan terms like LTV, term, if the collateral is held in cold storage or hot wallets, etc.

Explore Ledn’s Crypto Loan Options >

Pros and Cons of Crypto Lending

Pros of Lending Crypto

Crypto lending offers several advantages.

Earn passive income

Depositing into crypto savings accounts enables you to earn interest on your holdings without doing anything.

Access low interest rates

Crypto-backed loans offer relatively low interest rates compared to credit cards and personal loans. It is not uncommon to find crypto loans with interest rates below 10%.

No credit checks

Unlike traditional banks, most crypto lending networks and exchange systems do not require a credit check when you apply for a loan. This makes crypto lending accessible to individuals who may have a low credit score, lack a credit history or face difficulties in securing loans from traditional sources.

Fast funding

If you want to borrow against your crypto assets and your crypto-backed loan is approved, you receive the funds within a few hours. This can take weeks or even months with traditional loans.

Accessible and democratizing

You don’t need to undergo vetting processes, credit checks, or even have a bank account to start crypto lending. You just need to own some cryptocurrency, and be able to access the internet.

Cons of Lending Crypto

Your assets are tied up

Depending on the lending platform or protocol you choose, your funds may be locked up for a predetermined duration. You won’t be able to react to market movements. Check your platform’s terms & conditions though. Ledn Growth Accounts and Loans are very flexible.

Loan Collateral Liquidations

If the value of your loan collateral drops below a specified threshold, you may face a margin call. Lenders will require you to increase your holdings or provide additional collateral to maintain the loan. If you are unable to do so, you may have to sell some of your digital assets, potentially at a disadvantageous time.

Related Content: Crypto Loans Without Collateral

Varied repayment terms

Crypto-backed loans function similarly to installment loans, but the repayment terms can differ. You may need to create your own repayment plan to ensure timely and consistent payments. Checking the terms in advance allows you to assess your ability to meet these obligations within the given timeframe.

How Do You Benefit From Lending Your Crypto?

You can grow your crypto holdings by lending your crypto assets to borrowers, or by providing liquidity. There are a few ways to do this.

Crypto Lending Platforms

Crypto lending platforms connect lenders and borrowers, as well as handling the operational aspects of lending.

Related Content: Best Crypto Loan Platforms

Once your funds are deposited, they become available for borrowers to request. Borrowers can request loans by providing collateral or meeting other requirements set by the lending platform. Lenders can review and choose among the available loan requests based on factors such as interest rates, loan terms, and borrower reputation.

Once a loan is accepted, borrowers receive the assets, and lenders start earning interest on their lent cryptocurrencies.

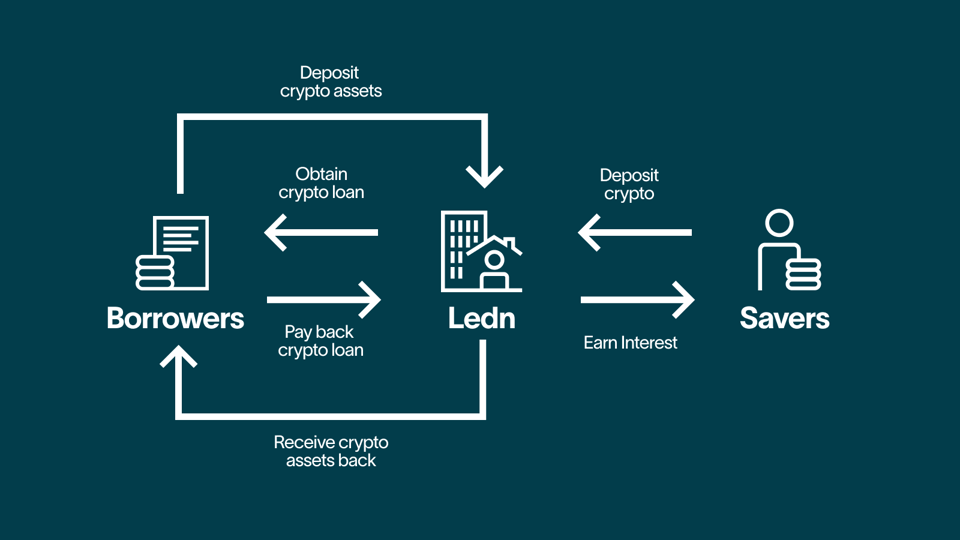

P2P Lending

P2P lending is a decentralized method of crypto exchange that relies solely on a blockchain-based platform or software. It offers more direct control and potentially higher returns. However, it also carries greater risks. There is a chance of default by borrowers, as well as potential fraud or misconduct.

Lenders create offers, specifying the terms of the loan, interest rates, and collateral requirements. Borrowers search for available lending offers and choose the most suitable option for their needs. Once an agreement is reached, the lender transfers the funds directly to the borrower, and the borrower repays the loan with interest over the agreed-upon period.

Related Content: How Crypto P2P Lending Works

Providing Liquidity

When you deposit your crypto into a platform’s liquidity pool, you contribute to the overall liquidity of the platform, enabling users to trade or borrow against those assets. In return for providing liquidity, you earn a share of the trading fees generated within the pool.

Providing liquidity comes with certain risks, including impermanent loss, where the value of your deposited tokens fluctuates more than if you hold on to them.

Decentralized Finance (DeFi) Protocols

Decentralized finance (DeFi) protocols are another way to lend your crypto assets and earn interest.

These protocols operate on blockchain networks. Users deposit their crypto into the protocol, creating a pool of assets that can be borrowed against. When users deposit their tokens, they become liquidity providers, allowing them to earn interest on their holdings as borrowers take loans against the deposited assets.

DeFi protocols use smart contracts to automate the lending process and ensure transparency and security. The interest rates in DeFi lending are typically determined by supply and demand within the protocol. When more users borrow against the deposited assets, interest rates increase, incentivizing more liquidity providers to participate. When demand decreases, interest rates decline.

Crypto Savings Accounts

Crypto savings accounts are the safest way to lend your crypto and earn interest. Like traditional savings accounts, they are a place to hold assets and generate passive income, while still maintaining a level of accessibility and flexibility in managing your holdings.

When you deposit your crypto assets into a savings account, the platform lends those assets to borrowers and pays you interest on your holdings. The interest rates are determined by factors such as the lending platform's business model, market conditions, and the type of cryptocurrency you deposit.

Crypto savings accounts are often provided by centralized exchanges, lending platforms, or dedicated crypto banking platforms. These platforms typically offer account management tools, user-friendly interfaces, and the ability to easily deposit or withdraw funds.

Related Content: Best Crypto Savings Accounts

Conclusion

Crypto lending is a simple way to earn passive income or access cash loans using your crypto assets. By lending your crypto, you can earn interest without actively participating in volatile markets. While there are risks involved, such as tied-up assets and margin calls, the potential benefits, including low interest rates, no credit checks, fast funding, and the ability to earn passive income, make crypto lending an attractive option for people who want to maximize their crypto holdings. Discover how Ledn can help you benefit from your digital assets without selling your BTC.

Sponsored by 21 Technologies Inc. and its affiliates (“Ledn”). All reviews and opinions expressed are based on my personal views.