As we’ve covered above, the coming week is packed with economic data and market-moving events. We get: FOMC meeting and interest rate decision, bitcoin options expiration, earnings from Apple, Amazon, Alphabet, Meta & more, plus a U.S. GDP print that could potentially confirm a recession.

We’ll get to the dates and times in a second - but first, a few words on moving the goalposts…

Many in the Economics community critique the Consumer Price Index, (the way in which inflation is measured and communicated to the public). Many people understand it as the price of a basket of goods that a normal person consumes on average. What they don’t pay attention to, is how the components of that basket change over time - and they do.

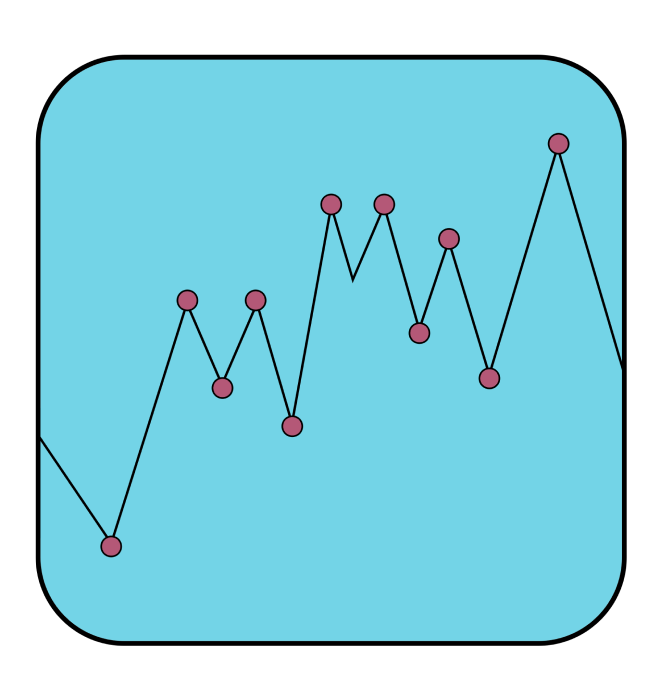

As you can see from the chart above, if the same calculation for CPI that was used in the 1980s were used today, it would yield to a CPI number that would be twice as high.

Even using the official data and looking at the slope of the curves, analysts have been able to show that the current inclination rate, on a year-over-year basis, is higher than it was in the 1980s.

Similarly, the upcoming Gross Domestic Product reading in the U.S. will likely signal a second straight quarter of negative growth.

Over the years, a recession was defined among economists as two straight quarters of negative GDP growth. However, there is now a campaign to “redefine” the meaning of recession - such that 2 straight negative GDP readings would not mean a country is in a recession.

Let’s just say the timing is interesting…

This is a great example of why it is good to get to the bottom of all official data sources. Sometimes, small changes can have very big and real implications.

Now, here are the earnings and announcements that could move the markets in the week ahead:

Tuesday

8 AM EST - FOMC Meeting starts

10 AM EST - Case Shiller Home Price Index (expectation is for an increase of 19.7% year-over-year)

Earnings: Coca-cola, Visa, McDonalds, Alphabet (Google), General Motors

Wednesday

2 PM EST - Federal Reserve Open Market Committee Interest Rate Decision

2.30 PM EST - Speech by Fed Chairman Jerome Powell

Earnings: Shopify, Meta (Facebook), Etsy, Hilton Hotels, Qualcomm

Thursday:

8.30 AM EST - U.S. Gross Domestic Product for Q2 2022

8.30 AM EST - Initial Jobless claims in the U.S.

Earnings: Apple, Amazon, Intel, MasterCard

Friday

8.30 AM EST - Personal Consumption Expenditures Index (inflation)

10 AM EST - Chicago Purchasing Managers Index

Earnings: ExxonMobil, Chevron, Procter & Gamble

It's a big week coming up, and as always, we'll keep you posted on any relevant news throughout the week right here and from our Twitter account.

This article is intended for general information and discussion purposes only, it is not an offer, inducement or solicitation of any kind, and is not to be relied upon as constituting legal, financial, investment, tax or other professional advice. This article is not directed to, and the information contained herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to law or regulation or prohibited by any reason whatsoever or that would subject Ledn and/or its affiliates to any registration or licensing requirement. This article is expressly not for distribution or dissemination in, and no services are being marketed or offered to residents of, the European Union, the United Kingdom or the United States of America. A professional advisor should be consulted regarding your specific situation. Digital assets are highly volatile and risky, are not legal tender, and are not backed by the government. The information contained in this publication has been obtained from sources that we believe to be reliable, however we do not represent or warrant that such information is accurate or complete. Past performance and forecasts are not a reliable indicator of future performance. Any opinions or estimates expressed herein are subject to change without notice. We expressly disclaim all liability and all warranties of accuracy, completeness, merchantability or fitness for a particular purpose with respect to this article/communication. For full legal terms and conditions visit https://ledn.io/legal

%20-%20BEC_CTA_B2X.jpg)