In today’s piece we wanted to do another deep dive into what drives the interest rates for both bitcoin and USDC Savings Accounts.

Changing market conditions for bitcoin and digital assets have resulted in compressing interest rates for both Bitcoin and USDC Savings Accounts in recent months.

As always, we like to be transparent and upfront with our clients and readers about the market forces that are driving these changes.

Let’s start with Bitcoin. We’ll cover two main use-cases or trades that institutions use borrowed bitcoin or USDC for (outside of Decentralized Finance schemes).

The main trade opportunity in this camp is the futures basis trade. This trade works when the price for bitcoin contracts for future delivery trade at a higher price than the spot price.

For example, let’s assume that you can buy bitcoin today at $35,000 and sell a contract to deliver that bitcoin in 3 months for $35,250. Implicitly, this means that you can make $250 ($35,250 - $35,000) by buying and holding the bitcoin until future delivery. This means that the implied yield on that trade is $250/$35,000 = 0.7%. That’s 0.7% for a 3-month period. To annualize this yield, we must multiply it by 4, since an investor could perform the trade 4 times in a calendar year. And so, the implied annual yield on this hypothetical opportunity would be 2.8%.

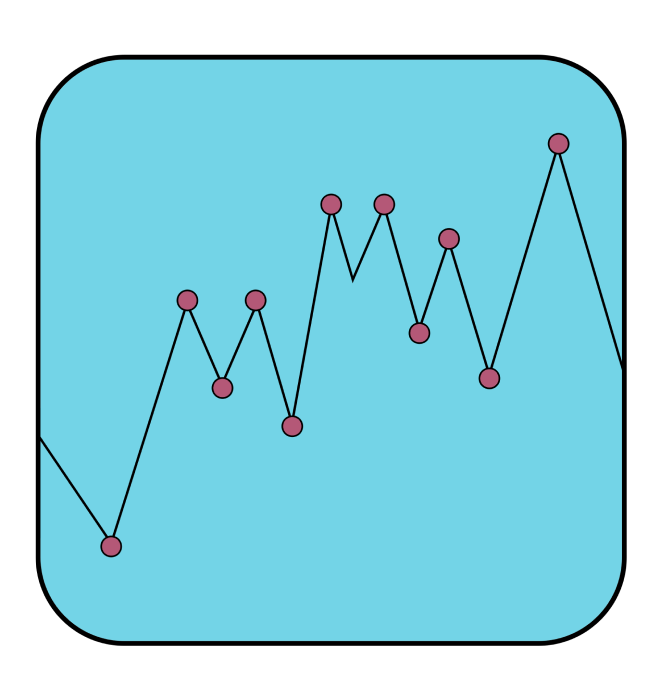

For a more concrete example, let’s look at the implied annual yield on the futures basis trade for 1-month out, and 3-month out contracts on the Chicago Mercantile Exchange (the safest of all futures venues).

As you can see from the chart above, the implied yield on the 1-month contract has compressed dramatically during the month of April. It went from about 6% at the start of the month to a low of -15%. An implied yield can be negative, this means that the “future” price of bitcoin is trading below the spot price. The implied yield on the 1-month contract is currently around 0%.

The implied yield on the 3-month contract paints a similar picture. From a high of about 5% at the start of the month to the current 1.66%.

In simple terms, the return on high-quality market opportunities at scale has compressed. This, in turn, forces the institutions participating in these market opportunities to lower their cost of borrowing. Which results in lenders, like Ledn, having to lower the rates they can charge institutional borrowers, and therefore having to lower the Savings rates we pay to savings clients.

- Market-Making (Price arbitrage)

Another common type of market opportunity for which institutions borrow bitcoin is to “make markets” across different exchanges. Because bitcoin has no “central price”, the price at which you can buy and sell bitcoin can vary - sometimes greatly, across different exchanges.

To take advantage of these small differences, institutions borrow large amounts of dollars and bitcoin to fund accounts across different exchanges and wait for the right opportunity.

A hypothetical trade would be to buy 1 bitcoin at $30,000 on Coinbase and immediately sell 1 bitcoin on Kraken for $30,050 - pocketing the $50.

As more market makers enter exchanges, the gap between the “bid” and the “ask” prices across exchanges should compress.

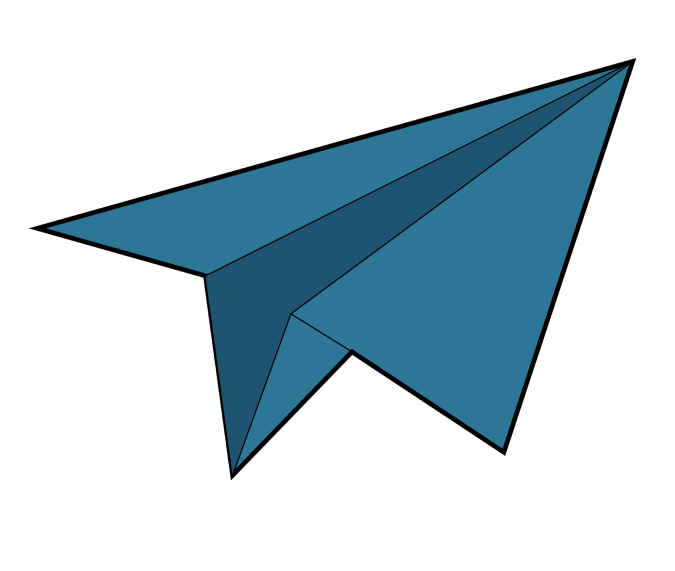

The chart above shows the average spread on a $1 million dollar buy order for bitcoin on Coinbase and FTX. As you can see, the average spreads have essentially halved over the last 3 months. From around 0.16% in February to the current 0.08%.

Additionally, the traded volume has also dropped - meaning that the market is getting much more competitive.

Again, in simple terms - this means that market makers are also seeing their average returns get compressed. Which forces them to have to lower their borrowing costs. Lenders, like Ledn, then have to reduce the rates that they charge to their institutional clients, translating into lower rates that can be paid to clients looking to earn interest.

Looking into the week ahead, investors seem to be expecting havoc and pricing a 99% probability of a 50 basis point hike. Equity markets have broken the lows from earlier in March and look to continue under pressure.

Interestingly, bitcoin has been performing quite resiliently in this environment - as we covered last week. The futures markets continue to flash signs of health.

Futures curves remain mostly in contango (prices increase as the future date is farther away) - and the funding rates for perpetual futures are positive (meaning that more leveraged investors are long than short).

Short interest for bitcoin on Bitfinex remains well below the highs of the year. Considering the kind of week we are heading into - this is a pretty healthy sign.