Crypto Mortgages: What You Need To Know in 2025

Homeownership is changing. For those holding Bitcoin or Ethereum, property financing no longer requires selling assets or approaching traditional banks for a mortage. Crypto mortgages are an alternative option.

Using digital currency as collateral, these loans settle quickly, bypassing appraisals and extensive paperwork. But they also carry risks, like market swings, liquidation, and evolving regulations.

This guide explains how crypto mortgages work, where to find them, and what to consider before putting your assets on the line.

What Is a Crypto Mortgage?

Borrowing against Bitcoin is emerging as a faster, cheaper, and globally accessible alternative to traditional mortgages.

Unlike home loans, Bitcoin-backed loans complete in minutes, require no credit checks, and offer flexibility in loan amounts without property valuations. They enable borrowers to unlock the value of their Bitcoin while avoiding traditional financial barriers.

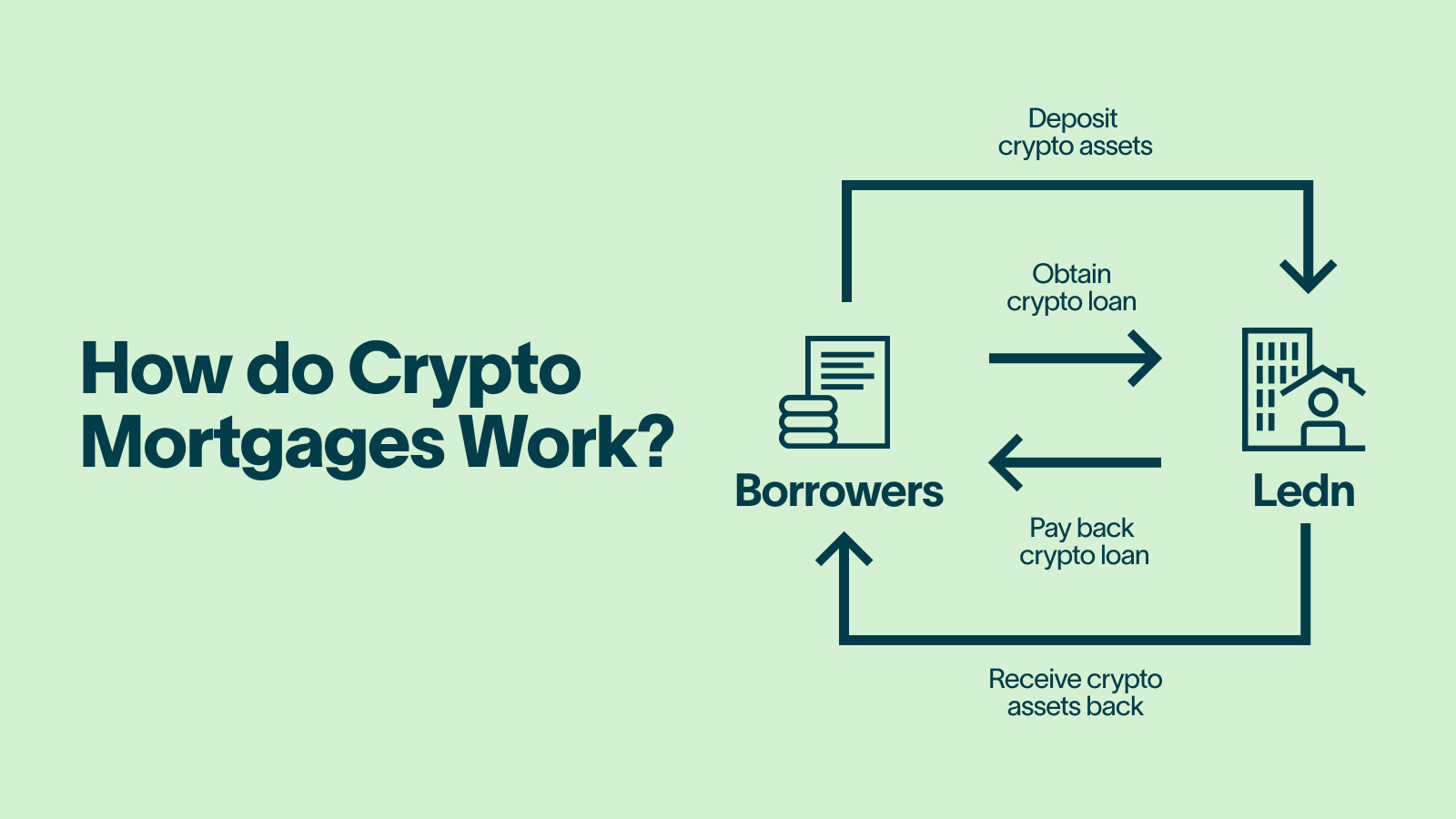

How Do Crypto Mortgages Work?

Crypto Mortgages allow you to use your cryptocurrency as collateral to buy property. Here’s how that works:

Choose Your Loan Type

- A general crypto-backed loan for flexible financing.

- A specific mortgage product tailored for real estate purchases.

Pledge Your Cryptocurrency

- Use your Bitcoin, Ethereum, or other assets as collateral.

- The lender holds the collateral until the loan is repaid.

Access Loan Funds

- The lender provides the loan amount based on the value of your crypto collateral.

- Use the funds to purchase property or meet other financial needs.

Repay the Loan

- Make repayments as per the agreed terms.

- Once repaid, your cryptocurrency is returned to you.

To learn more about crypto lending, check out The Ultimate Guide To Crypto Lending - Everything You Need To Know.

Where Can You Get a Crypto Mortgage?

Crypto mortgages offer fast, easy approval without selling your digital assets. Here’s how and where you can access them:

Ledn:

Ledn has managed over 6,500,000,000 USD in digital asset loans since 2018. You can borrow up to 50% of your Bitcoin's market value.

Ledn has partnered with Parallel to help customers buy properties in the Cayman Islands using cryptocurrency. This option is popular for securing residency or a “Golden Visa” without converting crypto to fiat.

Loans start at $1,000 USD equivalent in Bitcoin collateral, with automatic approval and no credit checks.

Loans are funded within 24 hours, and you can repay at any time without penalties. Interest may be tax-deductible.

Unique Features:

- Ledn performs regular Proof-of-Reserves audits to ensure transparency.

- B2X loans let you borrow and buy more Bitcoin, doubling your holdings when the loan is repaid.

- Its custodian, BitGo, is the world's first qualified custodian purpose-built for storing digital assets and has one of the most comprehensive insurance policies in the industry.

Other Platforms:

Milo: Offers crypto mortgages for U.S. and international real estate.

Figure: Provides crypto-backed loans for property financing.

USDC.homes: Specialises in mortgages backed by stablecoins like USDC.

What About Collateral Requirements?

The amount of cryptocurrency required as collateral varies depending on factors such as the loan amount, the lending platform, and the value of the property being financed.

You want to purchase a property that costs $500,000.

The lending platform's collateralization ratio is set at 40%.

Minimum Cryptocurrency Collateral = Property Price × Collateralization Ratio

Minimum Cryptocurrency Collateral = $500,000 × 40%

Minimum Cryptocurrency Collateral = $200,000

For this property valued at $500,000, you would need a minimum of $200,000 worth of cryptocurrency holdings as collateral to secure the loan.

Why Opt For A Crypto Mortgage

Crypto as Collateral

Crypto Mortgages allow borrowers to use cryptocurrency as collateral, unlocking its value without selling it.

Quick Access to Funds

By pledging cryptocurrency, borrowers can expedite loan approvals and avoid the extensive paperwork and delays associated with traditional mortgages.

Global Accessibility

Crypto Mortgages enable borrowers to secure loans from anywhere, allowing international investments and portfolio diversification.

Lower Credit Score Dependency

These mortgages rely less on credit scores because the cryptocurrency collateral reduces lender risk, making loans more accessible to those with poor credit.

Fewer Intermediaries

Crypto Mortgages streamline the lending process by reducing the need for intermediaries, potentially lowering transaction costs.

Read more: How to Borrow Against Crypto - Decoding Crypto Loans

Risks of Crypto Mortgages

Like any loan product, Crypto Mortgages come with risks that you should understand before committing.

Cryptocurrency Volatility

Crypto prices can fluctuate rapidly, risking margin calls or additional collateral requirements during downturns.

Liquidation Risk

Defaulting on a loan may result in your cryptocurrency being liquidated, potentially at a lower market value.

Regulatory Uncertainty

Changing regulations could impact the terms and availability of crypto Mortgages.

Smart Contract Vulnerabilities

Bugs or flaws in smart contracts may cause issues with loan terms or collateral management.

Platform Reliability

Platform vulnerabilities or operational failures could disrupt loans or risk collateral.

Limited Borrower Protections

Borrowers have fewer protections than traditional loans, with limited recourse in disputes.

Hacking and Security Risks

Choose secure, reputable platforms to avoid theft or breaches.

Requirements For Obtaining a Crypto Mortgage

Legal and Regulatory Compliance

If you take out a crypto Mortgage, you’ll still need to adhere to local laws and regulations governing cryptocurrency use and lending practices.

These include:

Cryptocurrency Regulations

Cryptocurrencies are subject to different degrees of regulation worldwide. Depending on your jurisdiction, you may encounter different legal frameworks related to cryptocurrency ownership, trading, and lending. Some countries have embraced cryptocurrencies, while others have imposed restrictions or bans.

Know Your Customer (KYC) and Anti-Money Laundering (AML) Checks

Many lending platforms and financial institutions require borrowers to undergo some KYC and AML verification. These procedures involve providing personal identification documents and verifying the source of your cryptocurrency holdings. This is to prevent money laundering and fraud.

Tax and Reporting

Cryptocurrency transactions may have tax implications. Tax authorities in some countries are increasingly scrutinizing cryptocurrency-related activities. Depending on your jurisdiction, you may need to report cryptocurrency holdings and transactions for tax purposes.

Documentation

To apply for a Crypto Mortgage, borrowers sometimes need to provide documentation. This may include identification documents, proof of cryptocurrency ownership, and any additional information required by the lender.

Read more: Best Bitcoin Loan Rates In 2025

Crypto-Backed Mortgages and Credit Scores

Crypto Mortgages may factor in creditworthiness, but they often prioritize the value of your cryptocurrency collateral.

Platforms with flexible requirements may overlook poor credit if you provide sufficient over-collateralization—pledging more crypto than the loan amount.

These loans generally don’t impact your credit score, but failure to repay could result in collateral liquidation and potential financial strain.

Conclusion

Crypto Mortgages open doors to homeownership with flexible collateral, swift access to funds, and global reach, all while accommodating diverse financial backgrounds. Ready to get started? Explore Ledn’s loans today.

Sponsored by 21 Technologies Inc. and its affiliates (“Ledn”). All reviews and opinions expressed are based on my personal views.

Sponsored by 21 Technologies Inc. and its affiliates (“Ledn”). All reviews and opinions expressed are based on my personal views.